Over the past year, we have tracked the evolution of QTS Data Centers and its emerging focus on the market for hyperscale data centers. The first step was the development of the Hyperblock, a super-sized data hall that can be quickly deployed within powered shell facilities, which QTS developed at its massive Richmond data center campus.

In recent months the company has shifted its development focus, moving beyond retrofits of mega-scale industrial facilities to focus on ground-up cosntruction in the nation’s largest markets, most notably a new greenfield data center in Ashburn, Virginia.

This week QTS continued its evolution as it announced a restructuring that sharpens its focus on the hyperscale opportunity, including a major step back from in-house cloud computing and managed services, which had been a pillar of its “3Cs” approach to the market. QTS says its will focus on providing colocation “on-ramps” to major clouds, rather than delivering those cloud services itself.

QTS executives say the company’s commitment to hyperscale has opened doors, making QTS a serious player in huge deals that will shape its future. “Our pipeline in the last 12 months has grown four-fold,” said Tag Greason, the Executive Vice President for Sales at QTS. “That’s a testament to the growth of the hyperscale market, and we can take take advantage of that growth.”

But the path to hyperscale is not always smooth, as seen in the investor reaction to the restructuring. In midday trading, shares of QTS plunged 20 percent, falling $9 a share to the $35 level. Analysts expressed concern that the company’s strategic shift and management reshuffling might result in uneven revenues in 2018. Some analysts also wondered if the company’s investment in high-touch cloud services, including the acquisition of Carpathia Hosting, had been a strategic mistake.

President and CEO Chad Williams said QTS has evolved with the market, remains confident in its strategy, and is determined win back the confidence of investors.

“This company has not done a good enough job on performing in 2017,” said Williams. “This company has to perform. This has to be the path to our vindication.”

Mega-Deals Offer Opportunity

Greason says the changes at QTS are driven by changes in the marketplace. The recent growth of cloud computing has super-sized the requirements for hyperscale customers, which now range from 5 megawatts to as much as 35 megawatts of space in major markets.

As a result, QTS is competing for deals ranging from 4 megawatts to 40 megawatts – a scale that would be the largest lease transaction in the history of the data center industry. The 40 megawatt requirement is not an outlier, Greason said, as there are several hyperscale customers seeking 20 megawatts or more, often across multiple markets. Competing for those deals requires flexibility with capacity and delivery timelines.

QTS has long been the master of the Internet-scale retrofit, finding former industrial facilities with sturdy infrastructure and transforming them into massive data centers The size of its buildings allow QTS to create custom data centers within the footprint of a larger facility.

In November the company announced an expansion of its development model, buying up land in the data center markets favored by hyperscale playerse. QTS acquired 53 acres in Ashburn, as well as an 84-acre property in Phoenix and 92 acres in Hillsboro, Oregon, a data center hub just outside Portland.

Williams said this move has given QTS a seat at the hyperscale table, resulting in a “dramatically different” level of interest from customers. “We’re just in much different conversations today than we were a year ago,” he said. “We’re seeing tremendous pipeline expansion.”

The decision to invest in land and greenfield construction built on the response to QTS’ introduction of the Hyperblock product, which can deploy space within 120 days.

“We saw such a significant trend last year with companies seeking 1 meagwatt to 2 megawatt increments of space,” said Greason. “Hyperblock has proven to be a a great offering.”

Greason said that a key differentiator for QTS is its ability to deliver Hyperblocks across multiple markets. He said these multi-market deals are becoming an attractive way for growing hyperscale players to expand quickly. One practice influencing this trend is cloud providers’ use of “availability zones” to provide geographic diversity for workloads, which helps with disaster recovery and latency.

Hybrid Colo: Still the Bread and Butter

While hyperscale is the new emphasis, QTS said it will continue to focus on hybrid colocation, which accounts for more than half of the company’s revenue. Greason said that QTS expects its colocation business to grow at roughly the same pace as the hyperscale market segment, as enterprises continue to transition from on-premises data centers to third-party facilities operated by service providers.

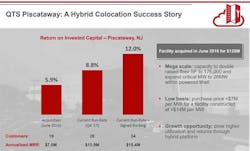

As an example of the growth trends in hybrid colo, QTS pointed to the progress at its data center in Piscataway, New Jersey, which QTS acquired from Du Pont Fabros Technology in 2016. The huge facility was built as a wholesale data center, but DFT struggled to fill the 18 megawatts of space in the first phase. QTS has shifted the focus to colocation, and doubled the customer count and annual revenue in just two years.

Growth trends at the QTS data center in Piscataway, NJ. (Source: QTS Data Centers)

Retooling the Cloud Offering

The biggest strategic shift in Tuesday’s restructuring announcement involved QTS’ in-house cloud services offering, the third “C” in the equation. QTS said it plans to shift away from these cloud and managed services offerings, which will be classified “non-core.” QTS will seek to divest many of these services, reducing the number of product offerings from 100 to just 15. This will allow QTS to reduce its costs by eliminating staff positions and licensing costs required to support these products.

“Our restructuring plan allows QTS to re-focus 100 percent of our resources on the two strongest growth drivers in our business and accelerate value creation for shareholders,” Williams said.

As part of the restructuring, QTS said it plans to eventually exit third-party data center space that was initially leased by Carpathia Hosting prior to its acquisition by QTS. Most of the space is in facilities operated by Equinix and Digital Realty.

“When we finalized the Carpathia deal our model was much different,” Greason said. “As these leases are up, we will ultimately exit these leased facilities. It just doesn’t match with our focus on owned and operated data centers.”

Greason said the move away from in-house cloud includes many services associated with the $326 million acquisition of Carpathia in 2016, but that deal is “just a piece of the story. These are complex services that are expensive to manage.”

A key driver in the cloud changes is the success of QTS CloudRamp, a dedicated colocation service that provides a direct connection the the Amazon Web Services cloud, and is featured in the AWS Marketplace. Greason said QTS has had an active order stream for CloudRamp in the four markets where it is offered, and noted that QTS can include other clouds in a similar offering. Effectively, QTS is shifting to a model where it enables and automates colocation cloud on-ramps, rather than delivering the cloud services.

“That’s really part of the plan,” Greason said. “The marketplace is really a platform play. We built a platform that is agnostic about cloud providers. The market is asking for more seamless connection to these public clouds.”