New Reports Show How AI, Power, and Investment Trends Are Reshaping the Data Center Landscape

Today we provide a comprehensive roundup of the latest industry analyst reports from CBRE, PwC, and Synergy Research, offering a data-driven perspective on the state of the North American data center market.

To wit, CBRE’s latest findings highlight record-breaking growth in supply, soaring colocation pricing, and mounting power constraints shaping site selection. For its part, PwC’s analysis underscores the sector’s broader economic impact, quantifying its trillion-dollar contribution to GDP, rapid job growth, and surging tax revenues.

Meanwhile, the latest industry analysis from Synergy Research details the acceleration of cloud spending, AI’s role in fueling infrastructure demand, and an unprecedented surge in data center mergers and acquisitions.

Together, these reports paint a picture of an industry at an inflection point—balancing explosive expansion with evolving challenges in power availability, cost pressures, and infrastructure investment. Let's examine them.

CBRE: Surging Demand Fuels Record Data Center Expansion

CBRE says the North American data center sector is scaling at an unprecedented pace, driven by unrelenting demand from artificial intelligence (AI), hyperscale, and cloud service providers.

The latest North America Data Center Trends H2 2024 report from CBRE reveals that total supply across primary markets surged by 34% year-over-year to 6,922.6 megawatts (MW), outpacing the 26% growth recorded in 2023.

This accelerating expansion has triggered record-breaking construction activity and intensified competition for available capacity.

Market Momentum: Scaling Amid Power Constraints

According to CBRE, data center construction activity reached historic levels, with 6,350 MW under development at the close of 2024—more than doubling the 3,077.8 MW recorded a year prior.

Yet, the report finds the surge in development is being met with significant hurdles, including power constraints and supply chain challenges affecting critical electrical infrastructure. As a result, the vacancy rate across primary markets has plummeted to an all-time low of 1.9%, with only a handful of sites offering contiguous 10-MW+ capacity for lease in 2025.

A key shift in 2024 saw Atlanta surpass Northern Virginia in annual net absorption for the first time, recording 705.8 MW of demand compared to Northern Virginia’s 451.7 MW.

Meanwhile, CBRE finds that AI-driven workloads are reshaping the data center geography, with secondary markets—including Charlotte, Northern Louisiana, and Indiana—gaining traction due to favorable incentives, land availability, and power accessibility.

Pricing Trends: Costs Climb Amid Supply Squeeze

CBRE's analysis noted that, with available capacity at a premium, wholesale colocation pricing in primary markets surged 12.6% year-over-year to a record $184.06 per kilowatt (kW) per month.

Historically, the firm notes that large tenants benefited from bulk discounts; but the scarcity of contiguous capacity has eroded these advantages, tightening cost structures for hyperscale deployments.

CBRE found that Hillsboro, Oregon, saw the sharpest price hike for 3-to-10-MW requirements, with rates soaring 46% year-over-year from $115.00/kW/month to $167.50/kW/month.

Rising construction costs, supply chain disruptions, and increased adoption of advanced cooling technologies—such as liquid and immersion cooling—are further contributing to price escalation, states the report.

Investor Confidence Remains Strong

CBRE concludes that the data center sector remains a top-performing asset class, with H2 2024 transaction volume exceeding $6.5 billion. Despite interest rate fluctuations, deal activity remained robust, with institutional investors, infrastructure funds, and private equity firms aggressively acquiring assets.

Key transactions cited by the new report include the following:

- Wren House & BlackRock forming a $1.2 billion joint venture with QTS to acquire three stabilized Northern Virginia data centers.

- HMC Capital acquiring a 32-MW hyperscale facility in Chicago from Prologis and Skybox.

- CyrusOne securing a $154 million deal for a self-occupied data center in Northern Virginia from PowerHouse Data Centers.

- Equinix finalizing a $15 billion+ joint venture with GIC and the Canada Pension Plan Investment Board for the operator's xScale expansion.

CBRE emphasized that the escalating scale of hyperscale campuses is driving valuations upward, with eleven asset sales exceeding $90 million and five surpassing the $400 million threshold.

AI and Network Infrastructure Drive Fiber Investment

The new CBRE data also chronicles how AI-driven workloads are fueling major investments in fiber and connectivity. Recent developments cited by the report include the following:

- AT&T’s $1 billion agreement with Corning to expand fiber infrastructure.

- Verizon acquiring Frontier, the largest pure-play fiber provider in the U.S.

- Lumen partnering with Microsoft to optimize fiber conduit for AI workloads.

- Meta advancing a 25,000-mile subsea cable initiative linking the U.S. to key global markets.

Looking Ahead: Power Challenges and Emerging Trends in 2025

CBRE forthrightly states that power remains the defining constraint in site selection for new developments. While flood plains have historically influenced site planning, the report finds operators are prioritizing power access, with some willing to invest in raised construction to mitigate environmental risks.

Meanwhile, the shift from coal to renewable power—along with interest in on-site generation, including solar, wind, geothermal, and nuclear—will be a defining theme in 2025, say CBRE. The analysis also notes how the data center industry is also seeing increased traction in natural gas on-site generation as a grid supplement to ease peak load constraints.

Overall, despite the record pipeline, CBRE says that supply is expected to lag behind demand, tightening vacancy rates and driving pre-leasing activity. The report notes that supply chain bottlenecks, particularly for electrical gear, continue to extend lead times beyond three years for large-scale developments.

Other key data center trends to watch in 2025, according to CBRE, are contained by the following questions:

- Can hyperscale operators push into rural sites 100+ miles from major metros?

- Will large-scale on-site power generation gain viability independent of traditional grid interconnection?

- How soon will Small Modular Reactors (SMRs) receive regulatory approval for deployment?

- Will sustainable solutions—such as hydrotreated vegetable oil (HVO) for backup generators and alternative concrete materials—become mainstream?

- How will utilities enhance grid infrastructure to accommodate surging data center power demands?

Finally, recent U.S. regional hotspots and market developments of particular note, according to CBRE, include:

- Kansas City: Long an enterprise market, Kansas City is drawing hyperscale interest due to Missouri’s competitive tax incentives. Google recently announced plans for a large-scale data center development.

- Pennsylvania: With abundant natural gas reserves, Pennsylvania is emerging as a focal point for on-site power generation. The state is also evaluating repurposing coal-fired plants for alternative energy sources, with discussions around restarting the Three Mile Island nuclear plant adding a new layer of potential power capacity.

Conclusion

CBRE's latest analysis confirms that, as 2025 unfolds, surging AI demand, evolving power strategies, and aggressive market expansion will continue reshaping the North American data center landscape. With limited available capacity, operators and investors must navigate supply constraints, rising costs, and evolving energy strategies to stay ahead in this rapidly shifting market.

PwC Report: U.S. Data Centers Drive Economic Growth, Jobs, and Tax Revenue

The data center industry continues to be a pillar of economic expansion in the United States, according to a new report commissioned by the Data Center Coalition (DCC) and conducted by PwC.

The independent study quantifies the sector’s contributions to employment, GDP, and tax revenue between 2017 and 2023, underscoring the industry’s growing influence on the broader economy.

Data Centers as a Jobs Engine

Between 2017 and 2023, PwC discerned that direct employment in the U.S. data center industry surged by more than 50%, outpacing overall national employment growth, which stood at 10% over the same period.

PwC’s analysis highlights the ripple effect of data center jobs, revealing that each direct job in the industry supports more than six additional jobs across the economy. The industry’s total employment contribution expanded from 2.9 million jobs in 2017 to 4.7 million in 2023—a remarkable 60% increase.

Economic Impact: A Trillion-Dollar Contribution

Meanwhile, the PwC report found that the data center industry’s contribution to U.S. GDP more than doubled over the six-year period, climbing from $355 billion in 2017 to $727 billion in 2023—a 105% increase.

When factoring in direct, indirect, and induced effects, according to PwC data centers contributed an astounding $3.46 trillion to the U.S. economy between 2017 and 2023.

The analysis emphasized how, for every dollar the industry adds to GDP, an additional $2.50 is generated elsewhere in the economy, reinforcing the sector’s role as a force multiplier for economic activity.

Tax Revenues on the Rise

The growth of data centers has also translated into significant fiscal contributions at all levels of government.

PwC data found that the industry’s total tax payments to federal, state, and local authorities surged from $66.2 billion in 2017 to $162.7 billion in 2023—an increase of 146%.

Over the report's six-year period, data centers contributed a total of $715.5 billion in taxes, further highlighting their role in funding public services and infrastructure.

A Key Driver of the Digital Economy

As demand for digital infrastructure continues to accelerate, PwC's analysis expects that the data center industry’s economic impact is poised to expand even further. With AI, cloud computing, and high-performance computing fueling continued investment, data centers remain at the heart of America’s digital transformation—powering businesses, communities, and the broader economy.

Cloud Market Soars to $330 Billion as Generative AI Fuels Growth

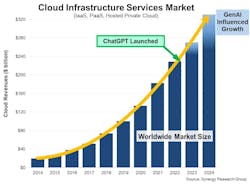

The cloud services market surged to $330 billion in 2024, driven by an accelerating demand for generative AI and GPU-intensive workloads, according to new data from Synergy Research Group.

The firm's latest analysis shows that enterprise spending on cloud infrastructure services reached $91 billion in Q4, marking a 22% increase from the same period in 2023. For the full year, cloud spending rose by $60 billion, further cementing the sector’s rapid expansion.

Generative AI has played a pivotal role in this growth, with Synergy estimating that AI-driven services have accounted for at least half of the increase in cloud revenues over the past two years.

The firm notes how, since OpenAI launched ChatGPT in late 2022, the cloud market has experienced an acceleration in AI-specific platform services, GPU-as-a-service offerings, and enhancements to existing cloud capabilities.

“Q4 was another strong quarter for cloud services, helping to drive a full-year growth rate that was a full four percentage points higher than 2023,” said John Dinsdale, Chief Analyst at Synergy Research Group. “For such a big market, that is an impressive acceleration of growth.”

Cloud Competitive Stakes Remain High

Meanwhile, the competitive landscape for cloud remains dynamic. According to Synergy Research, Amazon Web Services continues to hold the largest market share at 30%, but Microsoft (21%) and Google Cloud (12%) have grown at faster rates.

Tier-two cloud providers are also making gains, with CoreWeave, Oracle, Snowflake, Cloudflare, and Databricks posting strong year-over-year growth. The data notes that CoreWeave, in particular, has leveraged its focus on AI and GPU services to break into the top 20 ranking of cloud providers.

Synergy Research states that public cloud services—specifically Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS)—remain the dominant force, accounting for the majority of the market and growing by 24% in Q4.

According to the new data, the top three hyperscalers now command 68% of the public cloud sector.

Geographically, Synergy Research found that growth has been robust across all major regions, with Brazil, Spain, Italy, India, and Japan outpacing the global average in local currency terms.

The United States remains the largest cloud market, growing 23% in Q4, while Europe’s top-performing markets included Ireland, Spain, and Italy.

Data Center M&A Shatters Records, Surging Past $73 Billion in 2024

Finally, analysis from this January found that data center industry witnessed an unprecedented wave of mergers and acquisitions in 2024, surpassing $73 billion in total deal value, according to Synergy Research Group.

The analyst said the year’s transaction volume set a new benchmark, eclipsing the previous record of $52 billion in 2022. A major driver of this surge was the late-December closing of Blackstone’s acquisition of AirTrunk for nearly $16 billion—billed at the time the largest single deal in industry history.

Synergy's data shows how, following a slowdown in 2023, where M&A activity dipped to $26 billion, the rebound in 2024 was dramatic. Excluding mega-deals valued at $2 billion or more, the analyst found the volume of "regular" transactions jumped by 133%, indicating a renewed appetite for strategic acquisitions and investments in the sector.

Looking ahead, 2025 is already shaping up to be another strong year for M&A. More than $7 billion in deals had already closed as of January, with an additional $15 billion in pending transactions awaiting finalization.

Synergy is also tracking over $20 billion in potential future deals, as data center operators and investors continue to explore funding options and strategic partnerships.

“Demand for data center capacity has skyrocketed, driven by cloud services, social networking, and a wide range of digital applications,” said Dinsdale. “With generative AI now adding even more fuel to the fire, there is no sign of this trend slowing down. Specialist operators have either been unable or unwilling to self-fund these expansions, opening the door for private equity to step in.”

Private Equity Runs the Table

Synergy Research notes that private equity firms have played a dominant role in data center M&A, accounting for 80-90% of transaction value in recent years. This trend has intensified since 2020 when private equity’s share of total deal value stood at 54%, climbing to 65% in 2021 before stabilizing at today’s elevated levels.

Beyond the AirTrunk acquisition, the largest deals of 2024 included two separate equity investments in Vantage Data Centers totaling $9.2 billion, alongside additional funding for its EMEA operations.

Other notable deals included investments in EdgeConneX and DataBank, highlighting the continued appeal of hyperscale and edge computing infrastructure.

At the time of Synergy's report, the analyst said forthrightly that with record-breaking investment flows and a strong deal pipeline, 2025 is poised to be another pivotal year for data center M&A, as investors and operators position themselves to capitalize on the ongoing surge in digital infrastructure demand.

During PwC's Q2 2024 Quarterly sustainability webcast, Casey Herman, PwC Partner, and Chris Sharp, Digital Realty Chief Technology Officer, discuss the importance of AI and data centers in driving sustainability objectives.

At DCF, we talk the industry talk, and walk the industry walk. In that spirit, DCF Staff members may occasionally use AI tools to assist with content. Parts of this article were created with help from Open AI's GPT-4.

Keep pace with the fast-moving world of data centers and cloud computing by connecting with Data Center Frontier on LinkedIn, following us on X/Twitter and Facebook, as well as on BlueSky, and signing up for our weekly newsletters using the form below.

Matt Vincent

A B2B technology journalist and editor with more than two decades of experience, Matt Vincent is Editor in Chief of Data Center Frontier.