U.S. Contains Fully Half of 1,000 Hyperscale Data Centers Now Counted Globally, as Cloud Giants Race Toward AI

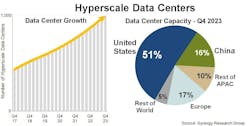

Reno, Nevada-based Synergy Research Group's latest industry data recorded that the number of large data centers operated by hyperscale providers increased to 992 at the end of 2023, and passed the mark of 1,000 early this calendar year.

Synergy's data shows that the United States still accounts for 51% of worldwide capacity, measured by MW of critical IT load, with Europe and China each accounting for about a third of the balance.

The firm's latest research is based on an analysis of the data center footprint of 19 of the world's major cloud and internet service firms, including the largest operators in the sectors for SaaS, IaaS, PaaS, search, social networking, e-commerce and gaming.

"While both the number of hyperscale data centers and their average size continue to grow at an impressive pace, there is a lot of complexity and nuances behind those trends," noted John Dinsdale, a Chief Analyst at Synergy Research Group.

Unsurprisingly, the companies with the broadest hyperscale data center footprint are the leading cloud providers – defined by the research as Amazon, Microsoft and Google.

In addition to a huge data center footprint in the domestic US market, each of the three cloud giants also has multiple data centers in diverse and widespread regions globally.

According to the Synergy Research, in aggregate the three now account for 60% of all hyperscale data center capacity.

In the new report, the big three are followed in the ranking by Meta/Facebook, Alibaba, Tencent, Apple, embattled TikTok owners ByteDance, "and then other relatively smaller hyperscale operators."

(No word on whether Oracle is considered really that much smaller or in any sense less "hyperscale.")

Pipeline and Capacity as Driven by AI

Synergy's forecast growth numbers are based in large part on its tracking of hyperscale operators' pipeline of future data centers.

Dinsdale added, "Generally speaking, self-owned data centers are much bigger than leased data centers, and data centers in the home country of a hyperscale company are much bigger than its international facilities -- though there are plenty of exceptions to these trends."

Meanwhile, Synergy Research notes that it has taken just four years for the total capacity of all hyperscale data centers to double, as the number of facilities grows rapidly and their average capacity continues to climb.

Looking ahead, Synergy forecasts that total hyperscale data center capacity will double again in the next four years.

While noting that each year will see some 120-130 additional hyperscale data centers coming online, the analyst emphasized:

"Capacity growth will be driven increasingly by the even larger scale of those newly opened data centers, with generative AI technology being a prime reason for that increased scale."

Hyperscale Hockey Stick

Synergy Research said its known pipeline of future hyperscale data centers currently stands at 440 facilities, which are at various stages of being planned, developed or fitted out.

Dinsdale also noted:

"We're also seeing something of a bifurcation in data center scale. While the core data centers are getting ever bigger, there is also an increasing number or relatively smaller data centers being deployed in order to push infrastructure nearer to customers. Putting it all together though, all major growth trend lines are heading sharply up and to the right."

Synergy Research's conclusions check out with what the latest data center industry news tells us.

Amid our recent sampling of the current spate of blockbuster hyperscale deals, Bloomberg's Matt Day last month did the math on the way to the contention that Amazon is investing $150 billion over the next 15 years "as a show of force" and "spending spree," as the hyperscale giant looks to retain cloud computing edge over Microsoft and Google.

The report pointed out that sales growth at AWS slowed to a record low last year as business customers cut costs and delayed modernization projects. Day added, "Now spending is starting to pick up again, and Amazon is keen to secure land and electricity for its power-hungry facilities."

Day noted that Amazon is looking to maintain its grip on top of the cloud services market, where it holds about twice the share of number two player Microsoft Corp., by bolstering its spending in data centers required for the present and expected ongoing boom in demand for AI applications and other digital services.

So it wasn't exactly a surprise when word escaped last week that Microsoft, never one to play second fiddle, has added 500 MW of capacity for data centers since July, and hopes to add another 1 GW of power over the next 6 months, according to leaked information from the company, as originally reported by Business Insider.

What is not a secret is that the key prerequisite for any so-called hyperscaler these days is to be in perpetual mega-expansion mode with data centers to meet AI demand.

Matt Vincent

A B2B technology journalist and editor with more than two decades of experience, Matt Vincent is Editor in Chief of Data Center Frontier.