Microsoft Hits Pause, CoreWeave Retreats: What It Means for AI Data Center Growth and Hyperscalers

The feverish ascent of AI infrastructure expansion, sometimes assumed to be an unstoppable force reshaping the data center landscape, is now encountering turbulence that calls into question the sustainability of its trajectory. We can't be sure if Microsoft’s sudden lease cancellations at multiple data center sites and abandoning of certain data center projects, paired with CoreWeave’s decision to scale back on its IPO, are mere blips on the radar. Could they be warning signals that the AI gold rush—heralded as the defining catalyst of the hyperscale build-out—is hurtling toward a different kind of inflection point? A reality check?

Microsoft, deeply embedded in the AI arms race, has been aggressively securing land and power for the past two years, riding the generative AI wave that made NVIDIA the new kingmaker of Silicon Valley. The hyperscalers' abrupt decision to walk away from multiple pre-leased data center sites suggests a reassessment of forward-looking capacity strategy. Whether it’s a matter of power constraints, construction delays, or a recalibrated view of AI-driven demand, the underlying message is clear: even the most dominant cloud players must reckon with shifting market realities.

Then there’s CoreWeave, the ostensible vanguard of AI-specialized infrastructure, now showing signs of strategic retreat. Its decision to downsize its IPO ambitions—initally positioned as a milestone in the AI infrastructure boom—reveals fissures in the investment thesis underpinning GPU-cloud providers. Investors, it appears, are less convinced that AI infrastructure unicorns can sustain sky-high valuations and capital-intensive expansion in an environment of rising costs and mounting skepticism.

This one-two punch should serve as a wake-up call to data center developers and financiers alike. For all the breathless proclamations that AI workloads will drive the next decade of data center growth, the industry is now staring down a more complex reality. The AI land grab may be giving way to a more measured, ROI-driven approach, where the bullish fervor of the past 18 months meets the cold calculus of economic pragmatism.

Does this spell doom for AI infrastructure expansion? Hardly. The need for GPU-dense, high-performance computing environments isn’t vanishing overnight. But the era of unchecked AI infrastructure exuberance may be drawing to a close. Microsoft and CoreWeave’s recent moves hint at an industry in transition—where capital discipline, efficiency, and real-world power constraints will separate the visionaries from the overzealous gamblers. The AI boom is not over, but its next phase will demand something far rarer than hype: discipline.

The Counterpoint: A Shiny Laser Pointer in the Big Picture?

Also, let’s not mistake momentary market fluctuations for existential threats. We've established that Microsoft and CoreWeave’s present media kerfuffles, while attention-grabbing, are far from the death knell of AI infrastructure expansion. Rather, it might all simply represent the natural ebb and flow of an industry undergoing rapid evolution—an industry where speculative investor hype sometimes runs ahead of operational realities.

Microsoft is no stranger to optimizing its capacity pipeline. Adjustments in site selection or lease commitments perhaps don’t signal retreat, but rather a fine-tuning of its strategy to align with power availability, efficiency goals, and evolving deployment models. Microsoft is still investing heavily in AI data centers, and a few lease terminations don’t erase its long-term commitment to GPU-powered hyperscale growth.

As for CoreWeave, its IPO scale-back could be more a reflection of market timing than an indictment of its business model. The AI infrastructure sector remains one of the most capital-intensive and sought-after investment categories, but public markets can be fickle. Investors may be demanding a reset on valuation expectations, but the underlying demand for high-performance cloud infrastructure remains unrelenting.

In the grand scheme, these headlines might be more on the order of shiny distractions—laser pointers that divert attention from the larger, undeniable momentum behind AI-driven infrastructure. The sector is still in the earliest innings of its expansion. In fact, from the dais at this week's DCD Connect New York event in Manhattan, Schneider Electric data center and AI development chief Joe Reele characterized its positioning as frankly "still in the on deck circle."

While some bets may need adjustment, for now it appears the industry's core trajectory remains the same: AI workloads are growing exponentially, the hunger for compute power is insatiable, and data centers will continue to be the foundation of this transformative shift. The AI boom isn’t stalling—it’s maturing. And that’s only to be expected.

Coda: The Hard Data Behind Hyperscale Growth

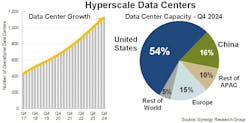

If Microsoft’s lease cancellations and CoreWeave’s recalibration suggest a cooling-off period, the latest data from Synergy Research Group presents a different picture—one of continued, even accelerating, expansion. According to Synergy, the number of hyperscale data centers worldwide has now reached 1,136, doubling in just five years. Even more striking, total hyperscale capacity—measured by MW of critical IT load—has doubled in less than four years, and is on track to do so again in the next four.

The new data shows the United States remains the undisputed leader in hyperscale expansion, accounting for 54% of global capacity, with Europe and China each representing about a third of the remaining balance. The three largest players—Amazon, Microsoft, and Google—now account for 59% of all hyperscale data center capacity, with Meta, Alibaba, Tencent, Apple, and ByteDance rounding out the next tier of major operators.

But the real story isn’t just the number of new facilities—it’s their increasing scale. The 137 new hyperscale data centers that came online in 2024 weren’t just numerous; they were significantly larger than their predecessors, with capacity growth now being driven more by the ever-larger scale of newly built facilities rather than just the raw number of additions. This trend has been “supercharged in the last few quarters as companies build out AI-oriented infrastructure,” said John Dinsdale, Chief Analyst at Synergy Research Group.

The hyperscale pipeline remains robust, with 504 new data centers at various stages of planning, construction, or fit-out. Each year, an estimated 130-140 new hyperscale facilities are expected to come online, reinforcing the steady march of cloud and generative AI-driven expansion.

As this data shows, the investment in AI data centers isn’t slowing down—it’s evolving. While market forces may prompt individual players to recalibrate, the larger trajectory is clear: AI is fueling a hyperscale arms race that shows no signs of abating. If anything, the numbers from Synergy Research suggest that what we’ve seen so far is only the beginning.

Alibaba chairman Joe Tsai this week alluded to a potential bubble in data center construction amid the growing demand for AI infrastructure. Intelligent Alpha founder and CEO Doug Clinton here joins Yahoo Finance 'Market Domination' hosts Josh Lipton and Julie Hyman to discuss while sharing insights on the current AI market cycle, and potential risks investors should consider.

At Data Center Frontier, we talk the industry talk and walk the industry walk. In that spirit, DCF Staff members may occasionally use AI tools to assist with content. Elements of this article were created with help from OpenAI's GPT4.

Keep pace with the fast-moving world of data centers and cloud computing by connecting with Data Center Frontier on LinkedIn, following us on X/Twitter and Facebook, as well as on BlueSky, and signing up for our weekly newsletters using the form below.

About the Author

Matt Vincent

A B2B technology journalist and editor with more than two decades of experience, Matt Vincent is Editor in Chief of Data Center Frontier.