Power Crunch: Dublin Grapples With Cloud Growth, Utility Constraints

What happens when a data center market runs short of electricity? As cloud computing grows faster than local utility grids, several of the world’s largest and most strategic data center markets are facing power constraints that pose a major challenge to the long-term growth of the Internet.

The challenge is seen most recently in Dublin, Ireland, which has emerged as a major hub for cloud platforms offering services in Europe. After years of expansion, the growth of data center construction near Dublin has been effectively capped by Ireland’s grid regulator operator, forcing utility EirGrid to halt talks on about 30 proposed projects.

Ireland’s prime minister, Taoiseach Micheál Martin, said last week that there “can’t be a moratorium” on digital infrastructure. Existing projects will move forward, and are expected to add at least 800 megawatts of additional capacity in the Dublin region through 2026.

Beyond that, prospects for additional data centers will be guided by how much energy Ireland can bring online, including at least 6 gigawatts of offshore wind power currently under development.

Dublin is hardly alone. Amsterdam, Frankfurt and Singapore have all slowed data center development as they study the best way to manage available supplies of power and land.

“I believe we’re a canary in the coal mine,” said Garry Connolly, President and Founder of Host in Ireland. “It’s because of our success that the demand is so great.”

The looming power challenges have the potential to reshape data center geography and design, as operators seek to extend their operations in key strategic markets. The bottlenecks could create submarkets in adjacent regions with greater availability of land and power.

The capacity crunch may also accelerate investment in new technologies that can support data center growth without straining local grids, such as Microsoft’s plans to share energy from their data center UPS battery storage systems with Ireland’s power grid.

The Challenges of Rapid Growth

Across the globe, data center development has been accelerated by the growth of cloud computing, and the accelerated shift to digital services during the COVID-19 pandemic. As a result, new cloud campuses are now seeking 100 to 200 megawatts of electricity, a dramatic increase from just a few years ago.

As a small country with a regulated power industry, Ireland’s grid has not been able to keep pace with that growth.

“There’s an actual grid physics issue,” said Connolly. “If I want 100 times more photons down a fiber cable, I can just change the (network) cards on each end. If I want the same on a grid, it’s a whole different process. It’s transformers and substations.”

“It really is this confluence of a very positive 2030, but a very challenging 2022,” Connolly added.

Ireland’s power grid currently supports around 5.5 gigawatts of power. About 1.2 gigawatts is currently dedicated to Ireland’s data centers, which Connolly estimates are operating at about 56 percent of that capacity at present, leaving some headroom for existing facilities to fill with customers.

UPDATE: On July 27, the Irish government released its policy statement on the role of data centers in the country’s economy and power grid, which states a “preference” for facilities that boost economic activity, embrace sustainability strategies, and reduce their impact of the grid.

“The capacity constraints experienced by our electricity system today, and the binding carbon budgets that require rapid decarbonization of energy use across all sectors, necessarily mean that not all existing demand for data centre development can be accommodated,” the statement reads. “Dublin’s transmission system has been pushed to its limit, with EirGrid advising the region will not be able to accommodate new requests for power from data centres until significant reinforcement of the transmission network is delivered, through the Power Up Dublin Plan. Substantial investment in infrastructure in Dublin and other constrained areas is required to address these challenges, and facilitate a smarter, more efficient grid for all users.”

This graphic summarizes the key factors and strategies that will guide future development decisions.

As they seek to sort through their options, data center operators are left with a number of strategies to enable continued growth in Dublin despite the power constraints. These include:

- Adding on-site generation, with natural gas the most likely fuel option.

- Shifting site selection to new areas that have more power and available land.

- Updating servers and designs to add compute capacity to existing space.

- Embracing strategies to use UPS units to share power back to the grid, a strategy now being pursued by Microsoft in its Dublin operations.

The longer-term outlook is more promising, as Ireland brings more renewable power onto its grid and data centers develop ways to incorporate energy storage, microgrids, grid-interactive solutions and hydrogen fuel cells, all of which can reduce the strain on local grids.

“The inconvenient truth is that data centers are huge consumers of power,” said Niall Molloy, CEO of Echelon Data Centres. “But equally inconvenient is the fact that without them, we would not be enjoying the benefits of 5G, e-commerce, the Internet of Things, artificial intelligence and virtual reality. Given, therefore, that data centers are here to stay, it’s up to us – the facilities’ owners and operators – to make provision to power them sustainably, cleanly and with least impact on the grid.”

Digital Acceleration During COVID Tests Dublin Market

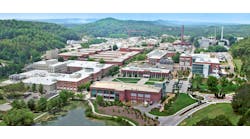

The western suburbs of Dublin have become one of the best places in the world to use fresh air to cool servers. That’s why it is home to a cluster of huge data centers that bring cloud services to European users, including server farms for Microsoft, Amazon Web Services, Facebook and Google. The combination of energy efficiency, a favorable tax environment and skilled IT workforce, has established Ireland as Europe’s leading hub for cloud data centers.

With strong connectivity to Europe, hyperscale operators flocked to Dublin, creating a massive cloud hub. Growth accelerated during the COVID-19 pandemic.

“It wasn’t until we got to 2016, with the explosion of the (cloud) platforms and hyperscales, that we started to see requests for campuses of 100 megawatts,” said Connolly. “We can’t underestimate what COVID has done for the digitalization of the planet.”

The rapid growth of the sector raised concerns about the growing use of energy for data centers. Despite the excellent efficiency profile of Dublin’s cloud cluster, environmental groups called for a moratorium on future development of data centers, citing concerns about the future use of electricity for the rest of the economy – including the renewable energy in the pipeline.

Instead of a moratorium, the Commission for Regulation of Utilities (CRU) called for a selective approach of limiting where data centers can be built, and suggesting operators “bring their own power” with on-site generation.

Similar tensions have been seen in markets around the world, including some of the most important focal points of data center business and connectivity:

- Singapore has had a moratorium on data center development for three years due to constraints on land and power. The moratorium is now ending, and last week Singapore’s Infocomm Media Development Authority began accepting applications for new data centers that “allow for calibrated and sustainable growth,” including best practices for efficiency (PUE of 1.3 of better) sustainability and international connectivity.

- In Amsterdam, local officials imposed a moratorium on data center growth in 2019, citing strains on power availability. which ended when the Dutch Data Center Association brokered a framework to allow data centers to be built in certain specific clusters, within a set budget of power and floor space. Then in Feb. 2021, the Dutch government banned new hyperscale data centers for 9 months while it develops new rules for data center development.

- In May 2021 officials in Frankfurt proposed new regulations on data centers, indicating that facilities should be built taller, take up less space, and share their waste heat, to address their energy consumption.

Ireland has taken a different tack. The limits are not government regulation so much as the market availability of power in some parts of the country.

“We can’t say no to all data centers because that potentially would be saying no to a lot of investment on the technology front both on the digital and the bigger companies,” Martin told the Mirror, adding that a new policy will be announced shortly that will “bring clarity” for businesses seeking to invest in Ireland. Martin indicated the government policy may require data centers to prove they can generate their own energy if necessary.

Bring Your Own Power – On-Site Energy Generation

On-site energy is not novel in Dublin, where natural gas generators have already been built for several large data centers.

One of the projects in Dublin planning to rely on natural gas generation is Echelon Data Centres. “On our DUB10 (Clondalkin) site, we have planning permission for a 100MVA gas-fired energy center, which will help smooth the flow in the grid (enabling the transition to 100% renewable energy), while providing back-up power for the facility thereby doing away with the need for diesel generators,” said CEO Molloy.

News reports indicate that Vantage Data Centers has included an on-site gas-powered generation plant on a proposed campus at Profile Park in Clondalkin.

It remains to be seen how much capacity can be added with natural gas, as that clashes with Ireland’s environmental priorities, which include a goal to use 80 percent renewable energy by 2030. Connolly noted that although on-site gas-powered generation may address the CRU’s concerns, it would draw scrutiny from the environmental regulators.

It remains to be seen how much capacity can be added with natural gas, as that clashes with Ireland’s environmental priorities.

A potential solution is biogas, a strategy Echelon is pursuing at its data center project Arklow in County Wicklow. Echelon and Biocore Environmental Ltd, an Irish company generating renewable power from biosolids, have reached an agreement to co-locate a biogas production facility on the Echelon Wicklow campus.

Energy Parks on the Horizon

Connolly predicts that the energy and data center industries will work together to create solutions. “You’ll start to see energy campuses in the greater Dublin area,” said Connolly. “We’ll start to see some of the renewable energy companies facilitating large users such as data centers.”

What might these energy campuses look like? Connolly points to projects like the Bord na Mona Energy Park as a model for the future. The enormous project spans 3,000 hectares (about 7,400 acres) about 40 miles west of Dublin’s major cloud campuses. The sustainable development hopes to co-locate a range of low-carbon energy generation assets – including wind and solar energy, hydrogen fuel cells and energy storage – with industrial-scale energy users like data centers.

The park is still in the development stages, but sits at a major intersection of 400kv, 220kv and 110kv grid networks, along with fiber infrastructure.

“My sense is that we’ll see a few more of these,” said Connolly, who said making these projects work “will require cooperation between the hyperscale platforms.”

Can New Tech Bridge the Power Gap?

Microsoft data centers will soon begin sharing energy from their battery storage systems with Ireland’s power grid, a move designed to help bring more wind energy onto the grid in the Dublin region. To accomplish this, Microsoft is using a “grid-interactive” UPS system from Eaton, which monitors and supports the data center power systems, but can also share energy back to the power grid.

“We have this battery asset in the datacenter that is just sitting there,” said Christian Belady, distinguished engineer and vice president of Microsoft’s datacenter advanced development group. “Why don’t we offer it to the grid and come up with a dynamic way of managing it as a dual-purpose asset and thus drive more efficiency and asset utilization? That’s what drove this win-win situation.”

An image of an NVIDIA-liquid cooled PCIe A100 GPU. (Image: NVIDIA)

The other opportunity to gain capacity is through equipment and design refreshes that bring bringing more computing power per watt into a strategic campus – improving both density and efficiency. Liquid cooling could become an important tool in boosting capacity in power-constrained markets. NVIDIA recently introduced its first data center GPU with direct chip liquid cooling, which the company hopes reduce the energy impact of artificial intelligence (AI) and other high-density applications.

Dialogue between stakeholders, the public and the industry, will be crucial to addressing the tensions between Internet growth and resource constraints. Connolly has been a tireless advocate for the digital economy and its ability to drive positive change, and says the industry must continue to tell its story effectively.

“Data is changing the world,” said Connolly. “The data is Airbnb, and Spotify and health services and many more. They’re the ones who need to be talking about solutions. The customers have a stake and they need to have skin in the game.”