As the data center sector continues its rapid growth, service providers constantly need room to expand their operations. This has become a guiding factor in industry acquisitions, with buyers seeking to acquire existing customers and facilities, as well as runway for future growth.

One example of this strategy is Iron Mountain’s $1.3 billion acquisition of IO Data Centers, which included 62 megawatts of operating facilities, as well as the potential to add another 77 megawatts in New Jersey and the hot Phoenix market.

This week Iron Mountain is moving to seize that opportunity. The company has launched construction on a 550,000 square foot data center on its Phoenix campus, on land adjacent to the former IO Phoenix facility. The project will add 48 megawatts of capacity in two phases, with the first 24 megawatts of capacity scheduled to come online in June 2019. Iron Mountain expects to invest $430 million in the new facility.

“As one of the fastest growing major markets in the U.S., and the 12th largest data center market globally, this expansion opportunity in the Phoenix area is an exciting opportunity for us,” said Rick Crutchley, vice president and general manager western region, Iron Mountain Data Centers. “The expanded campus will meet the growing demand from hyperscale, public cloud and global enterprise organizations that appreciate the Phoenix market’s unique combination of low power costs, outstanding tax efficiency and low geographic and weather-related risks.”

Data Center Growth in Phoenix

Phoenix has become one of the most dynamic growth markets in the U.S., with a surge in leasing in the past two years, including major deals featuring hyperscale cloud companies. IO, which has historically been the largest provider in the Phoenix market, has also built an impressive customer base among enterprise customers, including clients in finance, aerospace and technology.

The surging demand in Phoenix has also attracted new players, and prompted expansion plans by existing providers. EdgeCore, CyrusOne and Aligned Data Centers have all announced new campuses or expansions of existing properties.

As a result, the new building in Phoenix is a strategic priority for Iron Mountain, creating capacity to compete for deals across the full range of demand. IO initially announced plans to expand its Phoenix campus in 2016, and completed planning and approvals on the site prior to its acquisition by Iron Mountain.

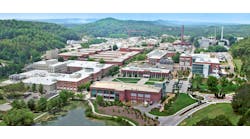

An aerial view of Iron Mountain’s Phoenix data center, against the backdrop of nearby mountains. (Photo: Rich Miller)

Iron Mountain says the new facility will meet the security and performance needs of the largest public cloud providers, as well as stringent compliance requirements for enterprise and public sector customers. The new data center will be built on a nine-acre parcel adjacent to Iron Mountain’s existing 38 MW data center in Phoenix, and have access to 25-plus carrier and network connectivity providers already deployed on the campus.

Aggressive Growth for Iron Mountain

When combined with current and potential capacity, Iron Mountain’s total data center portfolio potential represents more than 285 MW globally. That footprint has grown tremendously over the last year as Iron Mountain has been both building and buying new capacity. Here’s a quick review of Iron Mountain’s acquisition and construction activity over the last 12 months:

- July 28, 2017: Iron Mountain announced the acquisition of FORTRUST for $128 million. The deal added a 210,000 square foot data center in Denver, 9 megawatts (MW) of existing data center capacity and expansion space for an additional 7 MW.

- Sept. 18, 2017: Iron Mountain company opens the doors on the $80 million first phase of its new data center campus in Manassas, Virginia. The VA-1 data center is a down payment on a larger commitment to the Northern Virginia market, where Iron Mountain plans to build four facilities totaling $350 million in investment.

- Oct. 6, 2017: Iron Mountain agrees to buy two data centers from Credit Suisse through a sale-leaseback transaction in which the bank will stay on as an anchor tenant, and Iron Mountain will have the ability to lease the 10 MW of surplus space to other tenants.

- Dec. 11, 2017: The company said it will buy IO Data Centers for $1.3 billion, The deal includes data centers in Phoenix, Scottsdale, Edison, N.J. and Columbus, Ohio spanning 728,000 square feet of space and 62 megawatts (MW) of capacity. The IO footprint includes the potential to add another 77 megawatts of space in Phoenix and New Jersey.

- May 30, 2018: Iron Mountain buys Amsterdam’s EvoSwitch in a $235 million deal, providing the company with a footprint in one of the strategic markets in Europe.

Iron Mountain has spent 60 years building a reputation as the leading provider of document storage, with more than 230,000 customers around the globe. It sees the opportunity to win data center business with the power of its brand, particularly with customers in the government, healthcare and financial sectors that already partner with Iron Mountain to meet regulatory compliance requirement.

And for further coverage, check out Data Center Frontier’s page dedicated to the Phoenix Data Center Market, that will provide the latest stats and info on this quickly growing area that is becoming a leading market in the colocation industry.