The bitcoin mining boom has prompted a backlash in Washington state, where a local power board has proposed a rate hike for high-density power users. The Chelan County Public Utility District (PUD), which serves the Wenatchee area, wants to raise the rate for “high density load” customers from 3.4 cents per kilowatt hour to just above 5 cents.

Bitcoin mining operations and their landlords are protesting the rate hike, which targets users with a power density above 250 watts per square foot. That’s extreme density for a data center, but not uncommon in bitcoin mining, which requires power-hungry custom chips.

There will be community forum Wednesday in Wenatchee to discuss the utility’s new rates, which are scheduled to be considered at a PUD meeting on Feb. 16. About a dozen local bitcoin miners are expected to make their case that the pricing is discriminatory.

The Chelan PUD has some of the lowest power costs in the country, supported by a supply of hydroelectric power from dams along the Columbia River. That’s made it a magnet for bitcoin mining operations, who seek cheap electricity to process transactions on a global electronic ledger.

In 2014, the interest from the bitcoin sector went bananas. The Chelan utility received 34 inquiries representing 220 MW of capacity, compared to the 1 to 3 megawatts of load requests the agency fields in a normal year.

“Growth of this magnitude would have operational impacts such as system capacity and reliability, and on district staffing, as well as cost implications for all customers,” the Chelan PUD said in a presentation on the proposal.

The explosion of power requests in Wenatchee is an extreme scenario tied to the excesses of the bitcoin boom, and at first glance doesn’t figure to have implications for data center power provisioning in other markets. But the dispute in Chelan County provides a playbook for utilities seeking to target high-density users, a tactic that bears watching as the growth of edge computing creates demand for data centers in smaller markets.

Bitcoin’s Boom Days

Bitcoin mining has always been a speculative business, offering a way to mint digital money with high-powered hardware by processing transactions, with financial rewards paid out in virtual currency (hence the “mining” nomenclature). The network is based on a public ledger known as the blockchain, with each transaction verified using cryptography.

In December 2014, the Chelan PUD placed a moratorium on power requests of 1 megawatt or more, and created a working group to weigh the impact of bitcoin mining on the county’s power infrastructure. The utility said it was concerned about the transient nature of cryptocurrency mining operations.

Those fears proved clairvoyant. The moratorium insulated Chelan County from a huge shakeout in the data mining sector after the price of bitcoin plunged from $1,100 in late 2013 to just above $200 in early 2015. The price crash wiped out many mining operations, including CoinTerra, CloudHashing and PBMining. Another large player, GAW Miners, is facing a civil lawsuit from the SEC for securities fraud.

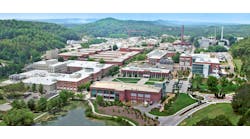

The Rocky Reach Dam, one of the dams on the Columbia River supplying cheap hydroelectric power to Chelan County, Washington. (Photo: Chelan PUD)

The price of bitcoin has since rebounded to $371, preserving opportunities for bitcoin miners who managed to ride out the sector’s nuclear winter. The survivors include companies that manufacture ASIC-based bitcoin mining hardware, including BitFury and KnCMiner.

But a number of operators in Washington state persevered, insulated by the extremely low coast of power in Chelan and nearby Douglas County and Grant County (which is home to a major data center cluster in Quincy). Among them is Dave Carlson, president of MegaBigPower, which runs one of the largest bitcoin hashing facilities in the U.S.

“When they announced the first moratorium, we had already received approval for a 2 megawatt project,” said Carlson. “I killed the project and moved all the power distribution to Douglas County.”

It’s the Economics

Many data centers in U.S. markets would be thrilled to buy power at 5 cents per kilowatt hour. But in the current environment, with American miners competing against huge bitcoin operations in China and the Baltics, the Eastern Washington bitcoiners say the price hike from 3 to 5 cents torpedoes their economics.

“This would make any bitcoin mining business very tenuous,” said Carlson. “They probably they just killed any new business in the county.”

Jared Richardson of Dedicated Hosting Services said the new rates would “wipe out our business in the area” and says the rate hike is discriminatory. Carlson noted that the rate proposal spares other industries.

“It’s very notable that they created this rate structure based on density of power,” Carlson said. “This allows existing large power users, like apple storage, to avoid the new rate.”

Apple storage? No, we don’t mean iPads and iPhones. Wenatchee is the “Apple Capital of the World,” and home to several of the largest fruit growers. These farms store fruit for up to a year in sealed controlled atmosphere storage facilities that manage temperature, humidity and the nitrogen and oxygen levels to put the fruit to sleep.

The apple industry has been the dominant player in the Wenatchee economy for decades, and thus is unlikely to cause controversy with its power use. Bitcoin, on the other hand, is a strange new business with volatile economics. To its credit, the Chelan PUD has taken more than a year to evaluate the demand and the stability of the bitcoin businesses, and held a series of public meetings at which it has been willing to listen.

“The overarching consideration is how these customers enhance the quality of life in Chelan County,” Chelan PUD Customer Service Director Andrew Wendell said in a presentation at one of the PUD’s public meetings. “It would be interesting if they could provide a nexus between their businesses and economic development in the community.”