Phoenix is in the midst of a data center building boom, and is drawing some of the biggest names in hyperscale computing. The Phoenix data center market is home to hundreds of megawatts of potential data center capacity, and demand is growing.

Download the full report.

Businesses, colocation providers and data center users have long flocked to Phoenix as an alternative to the California market, which comes with higher costs and disaster risk. But today, the Phoenix data center market is becoming a market leader in its own right.

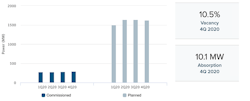

The Phoenix market is home to 1.97 million square feet (SF) of commissioned data center space, representing 295 megawatts (MW) of commissioned power at the end of 2020, according to market research from datacenterHawk. That makes Phoenix the fifth-largest market for data center capacity in the U.S., trailing Northern Virginia, Silicon Valley, Dallas and Chicago.

The most extraordinary data point for the Phoenix market is the planned future capacity, which is now approximately 1.6 gigawatts (GWs) of power and nearly 8.8 million SF of space. What’s less clear is the timing of when these data centers will be built and leased.

Mesa and nearby Chandler, Ariz., have become quality sub-markets, as well, notable for lower electricity and real estate costs.

This surge in demand has brought new companies to the drawing board in Phoenix, supplementing growth from existing players. These include Iron Mountain, EdgeCore, CyrusOne, QTS Data Centers, Digital Realty, EdgeConneX and Aligned Data Centers, which have all announced new development or expansion of their current properties.

The Phoenix market has also become a focal point for concerns about data center water usage. Extreme heat and drought are bringing sharper scrutiny of data center water use, and testing assumptions about climate in some data center destinations. The heightened awareness of water constraints is raising the bar for fast-growing hyperscale computing specialist, as well as data center developers.

What’s Driving Growth in the Phoenix Data Center Market?

A variety of factors have contributed to growth in the Phoenix data center market, including a favorable business environment for colocation providers.

As Lee McPheters, research professor of economics at Arizona State University noted in his 2020 economic outlook for Arizona, the state has rebounded to pre-2007 conditions, employing

2.93 million people, with over 80,000 new jobs created in 2019. That’s the highest employment Arizona has seen since October 2007.

The Phoenix data center market poses a low natural disaster risk, with almost no history of damage associated with seismic, tornado, and flooding events. The city ranks on the lowest scale of earthquake threat, according to the United States Geological Survey. This low threat for natural disasters has helped craft the area’s reputation as a disaster recovery market.

New tax abatement opportunities also have served to bring more data center businesses to the region. Arizona’s politicians have increased the appeal of the market to data center users by offering 10-year tax breaks on both data center equipment and labor services. Phoenix’ connectivity is also of note, home to impressive fiber infrastructure. CenturyLink, Electric Lightwave/Integra, Level 3, Sprint, XO, and Zayo all run long-haul fiber connections through Phoenix.

Dynamic Growth in Mesa, Goodyear

The list of companies with projects planned for Phoenix is lengthy. In the Eastern suburb of Mesa, EdgeCore is online with its first building and new capacity is planned by Digital Realty, CyrusOne, NTT Global Data Centers Americas and EdgeConneX. To the West of Downtown, Compass Datacenters, Stream Data Centers, Microsoft, STACK Infrastructure and Vantage Data Centers all have outlined plans for projects in Goodyear.

Many companies are so optimistic about future Phoenix data center demand they are already land banking and securiing property for potential development in the years to come. QTS has an 84-acre site in Phoenix to support its growing focus on hyperscale deals, while CyrusOne (68 acres) and Digital Realty (56 acres) have land in Mesa for future campuses.

The Iron Mountain AZP-2 data center in Phoenix, Arizona. (Photo: Iron Mountain)

In looking at the Phoenix data center market as a whole, data center supply and demand appear to be well-matched, with a vacancy rate of 9.4 percent in the region. A key factor is whether providers are able to successfully pre-lease space, or opt to build new projects on speculation in order to have inventory available for large deals – a strategy which is more

common in highly competitive markets.

The Phoenix region benefits from power and fiber infrastructure, and growing competition among service providers. (Photo: Alligned Data Centers)

Some of the biggest players in the Phoenix Data Center Market include:

- Aligned

- CyrusOne

- Cyxtera

- Digital Realty

- EdgeConneX

- EdgeCore

- Flexential

- H5 Data Centers

- INAP

- Iron Mountain

- PhoenixNAP

- QTS Data Centers

- zColo

Explore the Phoenix Data Center Market further through Data Center Frontier’s special report series and ongoing coverage of the growing colocation industry in Phoenix which can be found below.