The IoT Extends to Space: Satellite Startups Connect Remote Devices

Doug Mohney is the of Editor in Chief of Space IT Bridge, which tracks the business of space-based satellites. He has been working in and writing about IT and satellite industries for over 20 years.

Extending the Internet of Things (IoT) everywhere on the planet comes down to two essential factors, network availability and cost. Over 20 new companies promise to lower IoT satellite equipment and monthly service pricing by leveraging mass market production and using constellations of low-cost low-flying “nanosatellites” (the size of a wine bottle box or smaller) to collect data from devices in the remotest part of the world – or at least outside of cell phone tower range.

These companies are creating a new universe of possibilities for the IoT, enabling data-driven applications that extend beyond the limits of traditional networks. Early use cases envision satellites collecting data from ships at sea, farms in Africa, or solar-powered vehicles in Antarctica. It’s a trend driven by advances in satellite and battery technology that have altered the economics of space-based networks.

Two characteristics unite emerging satellite IoT firms around the world. All are focused on building low-bandwidth, low-cost data collection networks moving a few hundred to no more than a thousand bytes per device per day. Spectrum is the other discussion point – who has global licenses to it, who doesn’t, and why everyone else’s approach is flawed except their own.

After that, technical approaches diverge substantially. Many have launched nanosatellites into orbit a few hundred miles above the planet, ranging from shoebox-size hardware flown by Amsterdam-based Hiber all the way down to Swarm Technologies’ SpaceBEE coming in at a tight 2.5 x 10 x 10 centimeters – about the size of a sandwich – built in Silicon Valley.

Satellite IoT startups can launch one or two small satellites to get initial customers on board and revenues rolling, then add more as demand increases. Using smaller satellites bestows two advantages. “Our current thinking is to not be fully dependent on third-parties as our way to go,” said Coen Janssen, co-founder and Director of Business Intelligence at Hiber. “Second, we believe there’s an ample market for low revisit times verses near or real-time coverage. [Servicing a device] once per day, even once per week creates happy customers for us today while building up the constellation moving forward.”

Astrocast and Myriota will control their IoT network ecosystem from end-to-end, manufacturing their own silicon for OEMs and third-party developers to embed into devices, launching their own fleets of nanosatellites, and delivering the data through cloud-based services via web portals and accessible with APIs.

Open Standards Extend to Orbit

The newest of the new are building satellite systems using IoT open standards, testing and demonstrating the ability to pick up LoRa and cellular signals directly from orbit. These Low Earth Orbit (LEO) satellites’ attitude can range from 200 miles to 1,000 miles above the earth.

Lacuna Space is using a modified version of the LoRaWAN protocol to communicate with thousands of devices today, and plans to have five satellites in orbit by the end of the year. Lynk has shown it can pick up and deliver SMS text messages via satellite using 2G GSM. It plans to support LTE and NB-IoT in the future while OQ Technology conducted a technical demonstration between a satellite and an NB-IoT device on the ground last year.

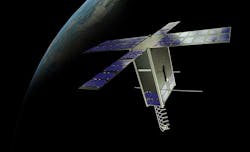

A compact SpaceBEE nanosatellite from Swarm Technologies. (Photo: Doug Mohney)

Smaller satellites and few bytes moved around translate to substantially lower service and ground hardware costs to connect things. “For a basic scenario of data pick up once per day, Hiber subscriptions start at 6 euros per year,” said Janssen. “Incumbents start at 36 euros a year up to 150 euros per year. You could create a similar comparison for the ground hardware involved.”

Janssen and the rest of the satellite IoT startups see themselves as broadening the overall IoT market by bringing in new customers rather than being in direct competition with Iridium and its recently refreshed $3 billion constellation of 66 operational satellites.

Initially built as a real-time voice and narrowband data network offering speeds of 2.4 Kbps, Iridium has been in operation for over two decades. Keeping track of and monitoring things around the world is a major business for the company, with new applications created as bandwidth speeds increase and new transceivers are introduced.

“IoT is 65 percent of Iridium’s business,” said Bryan Hartin, Iridium Executive Vice President of Sales and Marketing. “We have a wholesale model with a great ecosystem of partners.”

An Expanding Market for IoT Enablement

New satellite IoT entrants will have to open new avenues in part because Iridium’s existing customers are an installed base with multi-year commitments.

“We sign up and they’re good for the long haul,” Hartin said. “A lot of IoT blurs into different verticals. For aviation safety and voice, Boeing and Airbus want products to last for 10 years plus. They don’t want to touch or update or God forbid, rip out an existing solution from an airframe.”

Heavy equipment OEMs operate in a similar model. Caterpillar, Sumitomo and others are embedding Iridium IoT modules into new equipment rolling off the production line and retrofitting them to older equipment when it goes into the shop for maintenance, enabling real-time telematics monitoring.

“We could be monitoring a ‘Tonka truck’ in the middle of Africa,” said Hartin. “OEMs drive more revenue from service and parts than from the initial equipment sale. Extended downtime is a big loss. You want to make sure you get a truck into service before it breaks down in the field, otherwise it may take a long time to get it back to the barn to get it fixed.”

While most of its IoT offerings are built around its 2.4 Kbps data service, Iridium is expanding its offerings into what it calls a “midband” market between 2.4 Kbps and its higher-end broadband services between 70 kbps and 1 Mbps.

“We’re well suited for the small drone world,” Harlin stated. “You can’t have a huge antenna or large radio for command and control.” The Iridium Certus 9770 transceiver brought into service this year provides data rates between 22 Kbps and 88 Kbps, enough to monitor and control a drone out of visual distance regardless of distance or most terrain.

There should be enough more than enough business for Iridium and many of the new satellite IoT startups to successfully grow and thrive. ABI Research predicts there will be 24 million IoT connections made by satellite by 2024, according to its 2019 research report.

About the Author