Financial Sector Drives Demand in New York Data Center Market

We continue our series of stories on the leading geographic markets for data center space. Data Center Frontier partnered with DatacenterHawk to provide in-depth market reports on each city we profile. Read on for a special excerpt from the new New Jersey/New York Data Center Market Report.

Download the full New Jersey/New York Data Center Market Report.

Trends in Demand in New York Data Center Market

Data center demand in New York is dominated by the presence of the financial industry, which employs 330,000 in New York and accounts for more than 39 percent of the city’s economic output. Data center and IT infrastructure is critical to the operations of the city’s financial industry, tracking securities trading and storing transaction data. In recent years trading activity has been dominated by electronic platforms, including the rise of automated “robo advisor” services, and high frequency trading (HFT) operations that place enormous value on low latency computing and network operations.

Manhattan also has a high concentration of technology firms and startups (“Silicon Alley”), while the insurance, real estate and healthcare industries also drive demand for data center space.

Recent trends in demand have been shaped by two events: The financial crisis of 2007 and Superstorm Sandy in 2012.

The financial crisis prompted liquidity concerns that led many large corporations to conserve cash, including investments in single-tenant financial data centers. Many large financial IT firms became more amendable to working with service providers and operating in data centers controlled by third-parties.

Although NYC is at low risk for natural disasters, it was dramatically impacted by Sandy, which followed an unusual path that focused its storm surge on Manhattan and Northern New Jersey. High winds and severe flooding caused several NYC data centers to lose both utility and generator power. This pushed some of the users in these data centers to vacate the market altogether, while others have opted for space further uptown, outside of the most flood-prone regions in lower Manhattan.

[clickToTweet tweet=”NY Data Center Market Report – Data center demand in New York is dominated by the presence of the financial industry.” quote=”NY Data Center Market Report – Data center demand in New York is dominated by the presence of the financial industry. “]

In addition, there is an understandable concern about terrorist attacks in NYC, dating to the attacks on Sept. 11, 2001, which did extensive damage to network infrastructure in lower Manhattan. Data centers in the city plan for contingencies such as generator power, auto-failover, and data disaster recovery strategies. In the wake of 9-11, financial regulators emphasized the need for backup data center space for Wall Street firms to be “out of region,” boosting the market for DR space in New Jersey and beyond.

Growth in New York is often tightly tied to economic stability or instability. With the financial markets near or surpassing all-time records, it is likely corporations in the area will resume data center investments. This is reflected in the recent decision by a major financial firm to build a large single-tenant data center in the region.

New York is also likely to gain from the rise of Smart Cities technology that integrates data from devices (“The Internet of Things”). The city has been an early adopter of many security-related IoT technologies (security cameras, license plate scanners) as part of its post 9-11 focus on homeland security.

[clickToTweet tweet=”NY Data Center Market Report – Inventory of available data center space in NYC has trended lower over the past year.” quote=”NY Data Center Market Report – Inventory of available data center space in NYC has trended lower over the past year.”]

The city could also see future IT infrastructure demand from autonomous vehicles, which are the equivalent of supercomputers rolling down the highway, generating and transmitting a mind-boggling volume of data – up to 4 terabytes per day, per car. As driverless vehicles take to the roads, they will require low-latency wireless connections to fiber networks and data centers. This connectivity, storage and data-crunching infrastructure will need to exist almost everywhere cars can drive, but especially in major cities like New York.

Trends in Supply

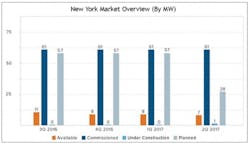

The inventory of available data center space in New York City has trended lower (from 11 MW to 7MW) over the past year, even as overall commissioned space has remained steady at 61 MW.

The largest and most densely-populated data center in the NYC area is 111 East 8th Avenue. The building grew into a colocation hotspot by attracting data center operators that wanted to be in the city and take advantage of the building’s connectivity. In 2010, Google purchased the 2.9 million SF building for $1.9 billion. As the data center operators’ leases in 111 East 8th expire, Google is taking back the space for internal purposes. Many data center providers are in the building with long-term leases, including Digital Realty, Equinix, XO Communications, and zColo. There’s also been some changes at 60 Hudson Street, the city’s other major carrier hotel. In 2012 DataGryd leased four floors within the building to offer as wholesale data center space. The building’s other major provider is Digital Realty, which acquired Telx to become the primary interconnection specialist at 60 Hudson, which houses dozens of telecom and data center service providers.

Additional data center developers and providers have invested in the lower Manhattan area. These providers focus on completing smaller more organic transactions in the market. The following data center providers have a significant presence in the buildings below:

- 65 Broad Street — 365 Datacenters, InfoRelay

- 75 Broad Street — vXchnge

- 32 Avenue of the Americas — CoreSite, Digital Realty

- 325 Hudson Street — Netrality Properties

- 85 10th Avenue — Telehouse America

- 811 10th Avenue — AT&T

In 2011, Sabey Data Centers purchased 375 Pearl Street, a 1.15 million SF former Verizon building overlooking the Brooklyn Bridge. Sabey has worked to redevelop the facility to deliver colocation solutions for both small and large users and has both power and space available for lease today. In 2014 the company began offering up to 15 stories of the 32-story building as office space, with the remainder focused on data center use.

While several data center providers are active in the New York market, most operators prefer to invest on large scale deployments in markets with lower costs. Although the density of businesses in the New York metropolitan area creates enough demand to occupy a large facility, the power costs alone can prevent data center providers from investing in the area.

This has prompted the emergence of a new data center sub-market in Rockland County, focused on the town of Orangeburg, about 25 miles north of Manhattan. In 2014 Russo Development and Sentinel Data Centers partnered to build a $700 million new data center for financial information provider Bloomberg LP.

Soon after, 1547 Realty recently announced the development of 1 Ramland Road in Orangeburg, which is on the west side of the Hudson River and closer to the New Jersey data center market than lower Manhattan.

This year financial giant JPMorgan Chase has pursued plans to buy land in Orangeburg for new data center construction. The company has interest in a 60-acre plot of land on the former Rockland Pyschiatric Center, which it will reportedly purchase for $7.5 million. The company’s plans were approved by local officials in May.

Several other providers have set up shop on the East side of the Hudson in West Chester County.

T5 Data Centers is marketing 600 Albany Post Road in Briarcliff Manor, NY, approximately 30 miles outside of lower Manhattan. The 38,000 SF building can be converted to accommodate 2 MW of critical power.

In 2Q, TierPoint announced the expansion of their Hawthorne campus in New York. The current building accommodates 52,000 SF of raised floor space, with the expansion adding 38,000 SF. The expansion project will be delivered in phases, with the first 13,500 SF coming in November.

In upcoming stories from the New York Data Center Market Report, we will explore some of the same trends specific to the New Jersey data center market.

For more on the New York/New Jersey data center market, we invite you to download the “Data Center Frontier Special Report: The New York/New Jersey Data Center Market,” sponsored by Digital Realty.

About the Author