Silicon Valley Data Center Market Sees Robust Leasing Activity

We continue our series of stories on the leading geographic markets for data center space with a report on the Silicon Valley Data Center Market. Data Center Frontier is partnering with DatacenterHawk to provide in-depth market reports on each city we profile. Read on to find out why the Silicon Valley data center market is positioned for it’s strongest growth in years.

Download the full report.

The Silicon Valley data center market is entering a dynamic new phase of growth and competition, featuring new providers and a robust cycle of new construction. Silicon Valley continues to be one of the largest and most important data center markets in the U.S., providing space for servers to deploy new hardware and services from the Valley’s marquee technology companies, as well as a legion of fast-moving startups.

The Silicon Valley market is positioned for its strongest growth in years in 2019 and 2020, with a steady supply of new capacity coming online. Three new players plan to enter the region’s data center market, while three leading incumbents are expanding their footprints with new construction.

The Silicon Valley area is home to 2.9 million square feet (SF) of commissioned data center space, representing 411 megawatts (MW) of commissioned power, according to market research from datacenterHawk. That makes Silicon Valley the second-largest market for data center space in the U.S. for the first quarter of 2019, trailing only Northern Virginia.

The cloud computing boom has created strong demand for data centers, and Silicon Valley continues to be a desirable site to deploy IT capacity, despite challenges in the availability and cost of development sites for data center capacity. In the current growth cycle for IT infrastructure, the absorption rate in Silicon Valley correlates closely with the amount of capacity available.

Strong Pre-Leasing for Vantage, CoreSite

In a powerful sign of continuing demand, two new projects have confirmed large pre-leases that will fill space as soon as it becomes available. Vantage Data Centers has pre-leased 21 megawatts of capacity on its newest data center, known as CA-21, which is scheduled to come online later this year.

“We have already fully leased the first building on our second Santa Clara campus and will soon begin construction of the second on this growing campus,” said Lee Kestler, Chief Commercial Officer. “Vantage launched from Silicon Valley, and the market remains a stronghold for us. As the largest provider in the Valley, we continue to see substantial demand with extensive requirements.”

In April, CoreSite pre-leased Phases 1 and 2 at its SV8 project in Santa Clara, representing 108,000 square feet of space.

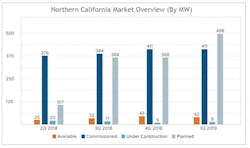

The biggest change from 2018 is the amount of new construction in the pipeline in Silicon Valley. There is now 498 MW of new capacity planned, up from just 104 MW at the start of 2018. This includes projects from new market entrants RagingWire Data Centers, CyrusOne and EdgeCore Internet Real Estate, as well as new construction from Vantage Data Centers, Digital Realty and CoreSite.

The Silicon Valley market is positioned for its strongest growth in years in 2019 and 2020, with a steady supply of new capacity coming online.

Silicon Valley provides one of the industry’s most compelling proximity stories. The region is home to America’s leading tech players, including Apple, Google, Facebook, Intel, Cisco, Oracle and many others. Its residents represent a huge base of tech-savvy consumers, who are consistently among the earliest adopters of new products and services.

Proximity to corporations and Internet consumers is a major factor in site selection, guaranteeing Silicon Valley a secure future as a major data center market.

That’s why Silicon Valley remains one of America’s busiest markets for data center space, despite expensive land, comparatively high cost of power and the risk of earthquakes.

This places a premium on new projects in Santa Clara, the region’s primary data center hub, due to its lower cost of electric power. Land is hard to find in Santa Clara, but its status as the Data Center Capital of Silicon Valley is reinforced by recent projects. Rather than building on open land in other towns, developers have paid more to acquire properties in Santa Clara with existing buildings that must be torn down and redeveloped.

The expanded roster of data center providers also will boost competition, as new players seek to establish themselves in this strategic market. New market entrants can impact pricing trends, and several new campuses planned for Santa Clara include design features (on-site power, enhanced earthquake protection systems) that are likely to be marketed as differentiators.

The new growth positions Silicon Valley to retain its position as one of the largest U.S. data center markets, particularly with the volume of projects in other markets. In recent years, strong growth trends in Dallas, Phoenix and Chicago have raised the prospect that one or more of those regions could surpass Northern California in size by 2020.

Phoenix and Dallas continue to have larger volumes of planned data center capacity, but the burst of new construction could well keep Silicon Valley in the number two spot. All these markets continue to trail behind the more than 1 gigawatt of future capacity planned for Northern Virginia.

The Importance of Santa Clara

Santa Clara boasts more than 40 data centers located in 18 square miles, rivaling “Data Center Alley” in Northern Virginia as the world’s largest concentration of data centers. The municipal utility, Silicon Valley Power, offers significantly lower rates than those available from PG&E in surrounding towns. The current price difference ranges between 25 and 40 percent.

New market entrants can impact pricing trends, and several new campuses planned for Santa Clara include design features (on-site power, enhanced earthquake protection systems) that are likely to be marketed as differentiators.

The preference for Santa Clara has been reinforced by challenges at PG&E, which sought Chapter 11 bankruptcy protection in January, citing current and future liabilities from the Camp Fire, which killed at least 85 people and destroyed 15,000 structures. In May, state investigators determined that PG&E equipment caused the fire, and the utility says disclosures and accounting of wildfire risks are under investigation by the Securities & Exchange Commission.

While the long-term impact of PG&E’s bankruptcy and legal woes is unclear, few are expecting that they will result in lower power prices.

The power pricing differential highlights the strategic importance of new projects in Santa Clara. This is also seen in higher prices for development properties. Two recent transactions illustrate this trend:

- In August 2018, CyrusOne paid $53.1 million to acquire a 15-acre property (about $3.5 million per acre) in Santa Clara, which will serve as part of its new campus. The company acquired an additional 8 acres in March 2019, but has yet to disclose the precise cost in its SEC filings.

- In April 2019 CoreSite paid $26 million for a 3.8-acre property (about $6.8 million per acre) in Santa Clara with an existing one-story building. The company expects to create a 200,000 square foot data center at the site.

For comparison purposes, in 2017 Microsoft paid $1.12 million per acre for undeveloped land in San Jose that could support a 50 MW data center.

Power is usually a more important cost factor than land in the total cost of building and operating a data center, so Santa Clara will likely remain the nexus of activity in Silicon Valley for years to come.

In our next article in this four-part series, we’ll take a look at the history and current market position of the Silicon Valley data center market.

For full details on the Silicon Valley data center market, we invite you to download the Data Center Frontier Special Report: The Silicon Valley Data Center Market, sponsored Vantage Data Centers.