Prince William County Weighs Proposals That Could Accelerate Data Center Growth

MANASSAS, Va. – With nearly 5.5 million square feet of data center space, Prince William County is already a hotspot for cloud computing infrastructure. It could see an acceleration of data center construction due to power constraints in nearby Loudoun County, potentially shifting the center of gravity for cloud growth in Northern Virginia.

But the future of Prince William’s cloud cluster will be guided by discussions in coming months about where data centers fit in the county’s vision for its future. As developers seek large parcels of land to support cloud campuses, they are looking beyond Data Center Alley in Ashburn, and Prince William County is one of several adjacent areas that could support growth.

But there are just a handful of properties in the county’s Data Center Overlay District that fit the criteria for today’s super-sized data center campuses. As a result, data center builders are now looking beyond the overlay district, and seeking to rezone land in other areas of the county.

That includes the Prince William Digital Gateway, a proposed 2,100-acre technology corridor in Manassas, which could accommodate up to 27 million square feet of data center development. Although the Digital Gateway project is likely months away from a decision from county officials, Compass Datacenters and QTS Data Centers are already seeking permission for massive campuses where they hope to build up to 18 million square feet of space.

The Digital Gateway is controversial because it is adjacent to one of the Manassas Civil War battlefields and a state forest. We’ve examined the political furor over the project in a related story (Neighbor vs Neighbor: A Community Debates Data Center Growth). But that project is just one component of a larger discussion about the role of data centers in Prince William County’s life and economy.

The Data Center Overlay District

Over the last six years, Prince William County has sought data centers as a targeted industry, and in 2016 created a Data Center Opportunity Zone Overlay District, aligning development with planning priorities and properties with supporting infrastructure. This has helped attract data center campuses for Amazon Web Services, CloudHQ, Iron Mountain, and QTS Data Centers, with projects under development by Digital Realty, STACK Infrastructure, and Yondr Group among others.

Prince William now has 33 existing data centers that make up 5.49 million square feet across 523 acres, with 13 data centers currently under construction. Of the existing facilities, 29 are located within the Data Center Overlay and account for approximately 4.94 million SF and 459 acres.

An illustration of the planned Gainesville Crossing data center campus being developed by Corscale in Northern Virginia. (Image: Corscale)

But developers have begun looking outside the overlay for new projects, often seeking larger parcels than are available within the district. Recent examples include the Gainesville Crossing project from Corscale (targeted for 2.3 million SF) and , and a new Gainesville campus for NTT Global Data Center Americas, which hopes to deploy 2 million SF of data center space. Last month the Planning Commission recommended approval of a 4.2 million SF data center campus in Gainesville, also outside the overlay. These campuses all span between 100 and 269 acres of land.

Why build outside the overlay? In the six years since the overlay was created, Internet growth has shifted the goalposts on the criteria for data center campuses. Developers are now building massive campuses for the bigger clouds of the future.

Of the 8,700 acres of land within the district, only 600 to 1,100 acres are “market viable,” according to a detailed county analysis, which found 79 parcels within the Data Center Overlay District that have zoning compatible with data center development, totaling 684 acres. Only 6 of these properties are more than 30 acres, and can support an estimated 5 million square feet of data center space (assuming a floor-to-area ration of 0.35).

Construction continues on some data center campuses within the Overlay. Just last week, Iron Mountain confirmed two more data centers for its Manassas campus. But new projects are seeking larger real estate footprints to ensure longer “runway” for expansion-minded hyperscale customers.

In May, the capacity crunch was summarized by Christina Winn, the Executive Director for Economic Development in Prince William County, in a memo to the county supervisors. “Economic Development has discussed minimum requirements with multiple data center companies, and 30 to 40 acres is the most common response,” Winn wrote. “However, please note that most data center requests are for 100 acres of contiguous land.”

Of the 8,700 acres of land in the Data Center Overlay Zone, “there are only two sites that would meet the 100-acre scenario of a data center requirement,” Winn wrote.

As a result, the county is currently considering whether to expand the overlay district, and what its expanded boundaries might look like. The district was previously updated in 2019, but in May the county began a comprehensive review of the county’s data center strategy that is examining the best locations and design standards for these buildings. The project ties into an ongoing effort to update the county’s comprehensive plan.

A new wrinkle emerged last year with the proposal for the Prince William Digital Gateway, which was structured as an amendment to the comprehensive plan, which would support subsequent rezoning applications. In July, the county planning staff issued a draft plan to recommend changes to some elements of the proposal, but made no recommendation.

Prince William is already positioned for data center growth, which could be boosted by an expansion of the overlay district. But there’s no question that the Digital Gateway proposal would take growth to another level, as is clear from the two early proposals from developers.

QTS Data Centers

QTS Data Centers has an existing campus in Manassas, as well as several campuses in Ashburn. Backed by the financial strength of Blackstone, which acquired QTS last year for $10 billion, the company is now competing for – and winning – some of the largest hyperscale deals. Its Digital Gateway proposal could take that initiative to the next level.

Its rezoning application seeks to develop an 800-acre campus, with the ability to build about 7.9 million square feet of data center space. The capacity would be spread out, with QTS describing two areas of development: Digital Gateway North, with up to 5.3 million SF of development on 470 acres, and Digital Gateway South with up to 2.6 million square feet of space on 342 acres. The space would be developed gradually, with full buildout expected by 2030.

QTS has said little publicly about the project, but industry sources say it sees the project as an opportunity to change the narrative around data centers as problematic neighbors. That will likely include a campus design that will prioritize environmental responsibility and the preservation of open space (including buffer zones that reduce impact on the Manassas Battlefield), as well as the intelligent management of water resources.

“We are committed to a thoughtful development strategy to preserve the historical significance and aesthetic beauty of the area,” said a QTS statement at the time of the March filing. “The Digital Gateway would represent one of the most significant economic development initiatives in the county’s history. … QTS has a strong track record of being a considerate, supportive and sustainable neighbor and is committed to a thoughtful development strategy that will preserve the historical significance and aesthetic beauty of the area”

The rezoning application says QTS will create protected open space along the border of Manassas National Battlefield Park and Heritage Hunt, a nearby senior housing development. QTS says its application aligns with the proposed changes to the comprehensive plan, which would include limits on the height of buildings so they don’t impact viewsheds from the battlefield of nearby housing.

Compass Datacenters

In June, Compass Datacenters submitted an application to rezone 825 acres along Pageland Lane, where it plans to build 10.5 million square feet of data center space. Compass has been building larger campuses in recent years, enabling customers to easily expand in phases to add additional capacity as demand dictates.

A Compass Datacenters facility under construction. (Photo: Compass Datacenters)

The properties would be maintained with 30% open space, which the application says could be dedicated to the county “for various active and passive recreation uses, such as an extension of the County’s planned Catharpin Greenway Linear Park, multi-use (biking, hiking and equestrian) trail networks, and connections to the lands owned by the Civil War Battlefield Trust along Pageland Lane.”

Compass declined comment on its proposal for the Digital Gateway. But the company has some experience with public controversy around projects in Northern Virginia. In 2018 it gained approval for a campus in Leesburg, which the Loudoun County Board of Supervisors passed in a 5-4 vote. The site was part of the county’s Transition Policy Area (TPA), which is envisioned as a buffer between business corridors and more rural sections of the county.

Residents argued that the Compass site was environmentally sensitive, and that the county should take more time to evaluate land use for the area. To address those concerns, Compass worked closely with county official to ensure that environmentally-sensitive land adjacent to the project near Goose Creek would be protected.

“Our team worked closely with the County to make a series of revisions to our plan to ensure that those environmental concerns are all addressed, and I see this as a model for how data centers companies, counties and residents can work together on these complex projects so everyone’s needs are met,” said Chris Curtis, Senior Vice President of Development & Acquisitions at Compass.

Data Centers and Economic Development

Data centers are non-traditional engines of economic development, which has traditionally been measured in full-time jobs. Data centers boost construction employment, but the completed facilities are highly automated, and can be run by 20 to 50 people per building. The tradeoff is that they generate large amounts of tax revenue and don’t create strain on local schools and traffic.

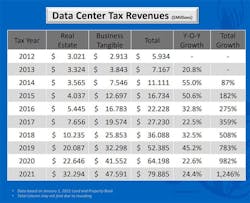

In 2021 Prince William County had $79.8 million in tax revenue from data centers, more than double the total from 2018. Here’s a look at the trend:

The projects already in the pipeline, both in and out of the Overlay, will boost that further, and the Digital Gateway could turbo-charge that tax revenue. The Prince William County Finance Department estimates that the Prince William Digital Gateway represents a potential investment of $24.7 billion, and annual tax revenue of $400.5 million.

That would bring Prince William into the same league as Loudoun County, which expects to see $575 million in tax revenue from data centers in 2022, equal to 31% of county revenue. The looming power pinch for new projects in Loudoun presents an opportunity for Prince William officials. But it also offers a cautionary tale, signaling that the ingredients for tax revenue growth from data centers include regional infrastructure as well as local decisions.

About the Author