Investment giants KKR and Global Infrastructure Partners will acquire data center developer CyrusOne for $15 billion, making it the largest M&A deal in the history of the data center sector. The deal will make CyrusOne a private company.

The acquirers will pay $90.50 per share, a 2.5 percent premium to CyrusOne’s closing price Friday, in an all-cash transaction that includes the assumption of debt. The transaction was unanimously approved by the CyrusOne Board of Directors, and is expected to close in the second quarter of 2022, pending approval by shareholders.

If completed, the deal will be the largest in data center history, topping the $10 billion acquisition of QTS Data Centers by Blackstone earlier this year, and American Tower’s planned $10.1 billion buyout of CoreSite, which was announced this morning.

The deals reflects the surging investment interest in the data center sector, which is being transformed by an unprecedented influx of cash and huge merger deals.

For CyrusOne, the acquisition ends a period of uncertainty amid changes in executive leadership, and positions the company to play at global scale in the fast-growing market for digital infrastructure.

“We see numerous opportunities ahead to continue expanding CyrusOne’s footprint across key global digital gateway markets and look forward to leveraging our global resources, access to long term capital and deep expertise to support the company’s growth,” said Waldemar Szlezak, Managing Director at KKR, and Will Brilliant, Partner at GIP.

“CyrusOne has built one of the strongest data center companies in the world and has a strong track record of development and operational expertise in addition to delivering best-in-class service to its customers,” said Szlezak and Brilliant. “We are excited to work together with the company’s proven team to build on CyrusOne’s market leadership and support their customers’ growing data center infrastructure requirements.”

Huge Platform Means Immediate Impact

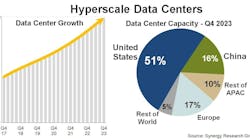

The world’s largest investors have been raising billions of dollars to invest in digital infrastructure, citing extraordinary demand for capital to fuel the data economy. Investment interest in data centers has been boosted by the growth of hyperscale computing, where the tenant is a giant corporation with excellent credit, lowering the risk profile for investors. Both trends loom large in today’s deal.

KKR has a 40-year history of high-profile deals, including leveraged buyouts like the 1989 takeover of RJR Nabisco. In recent years KKR has become a public company and expanded into additional asset classes. Last year the firm entered the data center industry with the formation of Global Technical Realty (GTR), which plans to develop more than $2.5 billion in data centers across Europe.

Global Infrastructure Partners is one of the world’s largest infrastructure funds, managing more than $79 billion in assets and offices in major global financial capitals. Infrastructure funds typically invest in large projects with predictable returns, such as airports, ports and energy generation – which are all well represented in GIP’s portfolio. These funds have taken a growing interest in the strong returns available in digital infrastructure, which fits their model for a capital-intensive sector.

In CyrusOne, KKR and GIP are acquiring an existing operating platform that has been a key beneficiary of the growth of hyperscale computing.

CyrusOne has been a leader in the rapid growth of the data center industry, advancing techniques for building at speed and scale. The company is on the forefront of a trend in which the world’s largest hyperscale Internet companies have begun leasing cloud capacity from data center developers, rather than building their own server farms.

CyrusOne operates more than 40 data centers and 4 million square feet of data center space across the globe, working with both hyperscale operators and enterprise customers, including 190 members of the Fortune 1000. The company’s focus on accelerated deployment has helped it reach the very top levels of the data center business. When applied at scale, over time, those techniques allow CyrusOne to create massive data center campuses.

“This transaction is a testament to the tremendous work by the entire CyrusOne team,” said Dave Ferdman, Co-Founder and interim President and Chief Executive Officer of CyrusOne. “We have built one of the world’s leading data center companies with a presence across key U.S. and international markets supporting our customers’ mission-critical digital infrastructure requirements while creating significant value for our stockholders,” said Dave Ferdman, Co-Founder and interim President and Chief Executive Officer of CyrusOne. “KKR and GIP will provide substantial additional resources and expertise to accelerate our global expansion and help us deliver the timely and reliable solutions at scale that our customers value.”

Ferdman returned to lead CyrusOne in July, when Bruce Duncan left the company after just a year as CEO. Ferdman is the fourth CEO for CyrusOne in the past 18 months. Ferdman founded the company in 2000 in Texas, where CyrusOne quickly found its niche specializing in high-density colocation services for energy companies in Houston and Dallas. The company expanded across Texas after it was acquired in 2007 by private equity firm ABRY Partners. In 2010, Cincinnati Bell paid $525 million to buy CyrusOne, which was then spun off in an IPO in January 2013.

Today, the company has been acquired again, starting another new chapter in its journey.

“Today’s announcement is the culmination of a robust strategic review process conducted by the CyrusOne Board of Directors to determine the best path forward for the Company and maximize stockholder value,” said Lynn Wentworth, Chair of the CyrusOne Board of Directors. “This transaction provides CyrusOne stockholders with significant value and simultaneously positions the Company to even better serve its customers to meet their needs in key markets around the world.”