Roundtable: Charting the Edge and Prefab Modular Inflection Point

Given the way the growth in digital infrastructure is going as fueled by the AI boom (colossally) -- the role of edge data centers and micro data centers is, ironically enough, set to become front and central.

As just one gauge of the current industry's temperature on this topic, in an insightful recent LinkedIn post entitled, "Embracing the Micro Data Center Revolution," noted data center industry influencer and distinguished business and technology leader Tony Grayson, who presently serves as Veteran's Chair at Infrastructure Masons and Compass Datacenters' GM in Seattle, contends that "the shift towards micro data centers (DCs) is beginning to happen."

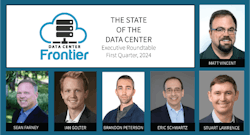

For today's installment of Data Center Frontier's Q1 Executive Roundtable, our five seaonsed data center industry leaders were polled on whether, in response to the generative and inference AI imperative, they think the industry is approaching a similar inflection point for the expansion of edge and prefabricated modular facilities to meet hyperscale capacity and compute demands, as it did last year with the expansion uptick in data center rack power densities.

Our distinguished panel of leaders for the First Quarter of 2024 includes:

Sean Farney, VP of Data Center Strategy for the Americas, JLL

Ian Golter, Engineered Solutions Manager - Datacenters, Kohler Co.

Brandon Peterson, Senior VP of Business Development, CoolIT Systems

Stuart Lawrence, VP, Product Innovation & Sustainability, Stream Data Centers

Eric Schwartz, CEO, CyrusOne

Now onto the second question of the week for our Executive Roundtable for the First Quarter of 2024.

Data Center Frontier: Is the data center industry approaching a similar inflection point for the expansion of edge and prefab modular facilities to meet hyperscale capacity and compute demands, as it did last year with the expansion of data center rack power densities in wholesale and colocation facilities, in response to the wave of heightened expectations for generative AI and liquid cooling stakes?

Sean Farney, JLL: Well, I'm a little biased because I founded a startup 10 years ago based on the premise that the edge would break out imminently! But I do think that many of the preconditions are right for a surge in facilities located in non-Tier 1 cities.

There’s a growing supply/demand imbalance exacerbated by deep-pocketed hyperscale developers who have effectively cornered the market on large sites. We also see a surplus of industrial and commercial assets available for adaptive reuse and a corresponding slate of board-level sustainability mandates encouraging such carbon-reducing circularity.

Finally, myriad new modular offerings from Compass Quantum, Vertiv, Schneider Electric and others have come a long way since the early days of shipping containers full of servers.

That said, I don’t think hyperscalers will necessarily drive commercial edge development. With vast internal portfolios of edge sites, they're already there. Instead, customer needs will propel growth.

First, there’s the continued growth of content distribution needs where the bits must be close to the consumer — think streaming media, health and safety, autonomous vehicles and virtual reality.

Second, at JLL we are getting inquiries from enterprises that need AI capabilities for product development or test/dev/lab environments and, for a variety of reasons, want it on-premises. Since most of these facilities cannot support AI's technical demands, we see an emerging opportunity for AI-specific modular environments that leverage companies’ acres of underutilized parking lots and new modular solutions.

In closing, I'd say that if the “edge” is Tier 2, 3 and 4 MSAs, recent announcements about huge new projects in Wisconsin, Iowa, Michigan, Ohio, Utah, Nevada and other non-traditional markets may very well prove that it’s already here.

Ian Golter, Kohler Co.: Keeping a longer-term view is essential rather than trying to parse too much from the current information.

We're still in the beginning stages of these next-generation technologies that will push higher megawatt data centers demanding turnkey solutions. We are still on the leading edge of a data center industry expansion that will continue for years.

Edge data centers and modular construction should be considered permanent fixtures in the industry that will continue to grow alongside the rest of the market. Still, an inflection point in market share is difficult to predict.

Brandon Peterson, CoolIT Systems: We still see much of the demand for AI and liquid-cooling going into traditional hyperscale and colocation data centers. However, with potential supply chain constraints on major data center infrastructure, options for edge / prefab modular facilities might become more desirable.

From a liquid-cooling perspective, edge and prefab modular facilities may drive different product requirements. Having a robust portfolio with multiple capacity and size options, as well as having well established product development processes that enable a fast time-to-market will allow us to help data centers with liquid-cooled AI no matter where it ends up being deployed.

Stuart Lawrence, Stream Data Centers: With current nationwide power constraints, all geographies are being viewed as possible new large scale regions, as a result near edge could now be considered near core.

With AI Learning and Inference needs, we see some divergence in latency requirements. From a capacity standpoint these Inference “Edge” clusters can be in the 10’s of MW’s, so I think the better statement would be that the core is expanding outward towards the edge.

Eric Schwartz, CyrusOne: CyrusOne is focused on building high performance datacenters at the scale necessary to support hyperscale requirements, and Intelliscale, our design architecture that supports higher rack densities, is well positioned to support customer needs. While Intelliscale uses prefabricated components, we are not focused on standalone edge facilities.

Next: Gauging the Level of Data Center Liquid Cooling Expectations

About the Author

Matt Vincent

A B2B technology journalist and editor with more than two decades of experience, Matt Vincent is Editor in Chief of Data Center Frontier.