Tennessee 'Opportunities Workshop' Ramps Commercial Nuclear Power Prospects for Data Centers

In the roughly two years since Chat-GPT made AI and its impact on data centers a central topic of conversation, the issue of finding enough power for data center growth and expansion has also become of central interest. That interest has made the prospect of more nuclear power a primary concern of the data center industry.

Why Nuclear Energy?

According to the U.S. Energy Information Administration's February 2024 report, total power generation last year, from all sources, was 4,178 billion kWh. And as of 2024, the 94 nuclear reactors operating in the United States generate about 19% of the nation's total power production.

Renewables (wind, hydro, solar, biomass, etc.) were responsible for slightly more, at 21%, but what that means is that nuclear generates just under 50% of all available clean power.

For an industry such as the data center sector that is rapidly making sustainability, decarbonization, and energy procurement primary focuses of interest, nuclear has become a high profile topic. To wit, the modeling of power system decarbonization has implied that the U.S. will need as much as 770 GW of additional clean, firm generation capacity to reach net-zero by the year 2050.

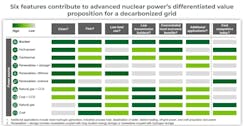

This aligns with the U.S. joing 28 other countries in a pledge to triple nuclear power production by 2050. As shown in the following chart, the value proposition for the decarbonization of power generation puts the potential development of nuclear power at the top of the list.

Nuclear Opportunities Workshop

In July at the East Tennessee Economic Council’s Nuclear Opportunities Workshop in Oak Ridge, Tennessee, Brian Smith, Acting Deputy Assistant Secretary for Nuclear Reactors, Office of Nuclear Energy, U.S. Department of Energy, spoke on the government’s efforts to, if not restart, then perhaps reinvigorate the development of nuclear power in the U.S.

Many of the development programs and funding opportunities for nuclear energy predate the more recent focus on the significant power demands of the data center industry.

Smith pointed out the importance of investments in public/private development intitiatives, acknowledging that efforts initially funded in 2020 by the Advanced Reactor Demonstration Program (ARDP), which supported cost-shared programs with industry partners, and have recently started breaking ground and becoming tangible potential assets for power generation.

The ARDP is leveraging the capabilities of the Nuclear Regulatory Commission’s National Reactor Innovation Center, which works with the seventeen existing DOE national laboratories to examine the challenges and address issues that hinder progress with the development of nuclear power.

Secretary Smith commented that in his role with the DOE, he often sits down with data center companies who tell him that they're really interested in nuclear energy - but don’t really know what that means.

He stated jokingly that "much of their knowledge is based on watching the Simpsons."

More seriously, he said he finds himself often putting the current state of nuclear power into context, identifying the large-scale reactors that represent the current power generation facilities and explaining how microreactors and small modular reactors (SMRs) can fit into the future plans of these data center companies.

Where Is the Money Going?

Some of the funding for nuclear energy expansion has been for very basic things.

For example, 2023’s national security supplemental appropriations bill included $2.7 billion to increase domestic uranium enrichment, critical for the operation of nuclear power plants.

Low-enriched uranium (LEU – 3%-5% fissile U235-isotope), sourced from three different domestic sites, is used by most existing commercial nuclear reactors. This investment is absolutely critical to the future of domestic nuclear power.

High assay-low enrichment uranium (HALEU – 5%-20% U235) is being used by many of the new, advanced reactor designs, including several of the SMR and microreactor designs that have been proposed and are currently under development.

However, one of the only sources for readily available HALEU fuel, as noted in news reports earlier this year, is via purchases made from Russia, a not-too-viable solution given the current global political situation.

Money is also being spent to further drive the public/private partnership aspect of available funding.

Smith told us, “There was somebody that I really respect in this industry who said, 'Hey, you know, one thing that I see lacking at DOE: you all are real good at the R&D, everything you do with the labs, everything that you do to support demonstration -- but you all don't do commercialization all that well.”

Addressing this industry concern, of the $900 million available in the fiscal 2024 budget for projects to actually deploy a generation 3+ SMR, $800 million requires that the primary applicant for the funding must be a utility company.

Smith added, “We want the utilities to partner up with the technology vendors, show us your best ideas, and go and actually deploy a Gen 3+ SMR.”

He also pointed out that this notion represents a shift in thinking from the perspective of the DOE, with the active encouragement of commercial utilities connecting to many of the DOE startup-funded advanced nuclear partners.

What’s Next?

It’s clear that the data center industry is taking nuclear power seriously. Hyperscalers Amazon, Google, and Microsoft have all expressed significant interest in utilizing nuclear power.

Amazon purchased space from Talen Energy collocated with a nuclear power plant earlier this year. Microsoft and Google have teamed up with Nucor on clean energy projects. Bill Gates, through his TerraPower nuclear startup, spent $2 billion to match the $2 billion from the federal government, and we’ve covered many of the letters of intent signed with startup Oklo to provide significant power capacity to data centers.

Many of the advanced nuclear startups are looking to have demonstration reactors running in the next two to three years, with full scale power generation available by early 2030.

What that tells us now is that there is no simple answer. It’s not only a technology issue, as all eyes will continue to be focused on the NRC and the approval process for deploying commercial nuclear power. Changes are being made, but the extended, multi-decade time frame that many commercial reactors saw in the past is unacceptable for future deployments.

From listening to speakers representing the government at the conference, this is also an issue that the DOE and NRC will be addressing -- hopefully, in time to meet the energy demands of the data center industry and the rest of the country.

About the Author