When you mention the cost of power, most data center operators talk about their local utility. John Sheputis sees it in another context: the power of choice.

As CEO of Infomart Data Centers, Sheputis views the local power company as an ally in a larger goal: procuring the cheapest, greenest power possible for the company’s data center customers. Infomart has worked with utilities in Silicon Valley and Portland, Oregon to make this happen, taking advantage of programs that allow industrial customers to source electricity from a selection of energy suppliers.

“Now we canvas the market and choose the provider we want based on price and carbon content,” said Sheputis. “We have a competitive advantage on power.”

In San Jose, Infomart uses the PG&E Direct Access program to offer power to customers at rates of 8.5 cents to 9 cents per kilowatt hour, much lower than the 11 to 12 cents per kWh rate seen by most PG&E customers in the area.

“It is a strategy for us,” said Sheputis. “We want the power to choose. It’s not some kind of magic. The utilities buy and sell power from one another all the time. They don’t often extend that to consumers.”

Infomart was an early adopter of a more sophisticated approach to power sourcing, which is now gaining more prominence in the data center industry. Utilities operate under different business models in various markets, and not all offer direct access options. But virtually all large data center operators are investing more time in energy, and how it is generated and procured.

Multi-Tenant Providers Going Green

Electricity is the lifeblood of every data center. The shift toward renewable energy marks the second phase of the data center industry’s effort to address its massive use of energy. The first phase focused on energy efficiency, applying innovation in data center design to slash consumption of grid energy. The second phase is a tougher challenge, as the data center sector must work with – and sometimes work around – a U.S. utility industry that has been slow to embrace renewable energy.

Hyperscale data center operators like Google, Facebook, Apple and Amazon have been the leading players in sourcing “green” electricity to power their massive data centers, prompted both by internal commitments and external prodding.

The search for green power has now been embraced by multi-tenant data center providers, who say customers are including the carbon impact of power in their criteria for choosing a provider.

- Equinix, the world’s largest provider of colocation services, announced plans in 2015 to shift its entire global data center network to run on clean and renewable energy.

- In July Digital Realty entered into a long-term agreement with E.ON Climate and Renewables to procure approximately 400,000 megawatt-hours of wind power annually, which will offset 100 percent of Digital Realty’s U.S. colocation and interconnection energy usage. ” “Digital Realty recognizes the importance of addressing our customers’ growing demand for renewably powered data centers,” said CEO William Stein.

- Switch reports that ad of As of January 1, its SUPERNAP data centers are fully powered by renewable energy from NV Energy. Later this year, Switch will tap more than 180 megawatts of solar farms in Nevada to supports its data centers. “Switch has cemented itself as the leader of sustainability in the data center industry,” said CEO Rob Roy.

- Last week Iron Mountain signed an agreement to purchase enough wind power to support 30 percent of its North American electricity footprint. “We believe that renewable energy strategies can benefit our business, positioning Iron Mountain and our customers to meet the growing expectations for sustainable business practices,” said Ty Ondatje, senior vice president of Corporate Responsibility for Iron Mountain

Direct Access Programs Offer Options

Sheputis was ahead of the curve, as he has been sourcing green power since 2010. As CEO of Fortune Data Centers, a wholesale data center provider which later became part of Infomart through a 2014 merger. Sheputis took advantage of a limited reopening of California’s Direct Access program to non-residential customers. Under Direct Access, eligible utility customers can choose from multiple energy suppliers.

PG&E, which serves San Jose, makes money by charging for transmission and distribution, rather than a profit on the sale of electricity itself.

Customers using Direct Access typically pay one fee from the third-party energy provider they select, and a separate fee from PG&E for distributing the power to their facility.[clickToTweet tweet=”Infomart CEO John Sheputis: We choose the provider we want based on price and carbon content.” quote=”Infomart CEO John Sheputis: We choose the provider we want based on price and carbon content.”]

In San Jose, the primary advantage of Direct Access is pricing. It allows Infomart to offer cheaper rates than its immediate neighbors, but also to compete with providers in Santa Clara, where municipal utility Silicon Valley Power offers rates as low as 9.5 to 10 cents per kilowatt hour.

Sheputis said Infomart’s tenants could save hundreds of thousands of dollars per year on energy costs, or opt for renewable energy to further reduce carbon emissions, which is the focus in Oregon.

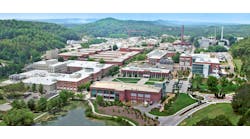

An aerial view of the Infomart Data Centers facility in Hillsboro, Oregon, which sources low-carbon power from the Bonneville Power Administration. (Photo: Infomart)

One of the reasons Fortune chose to expand in Portland was that the local utility, Portland General Electric, offers a Direct Access program. Fortune, which became part of Infomart in a 2014 merger, was able to source renewable electricity from the Bonneville Power Administration that was both greener and cheaper than the options in Portland.

“The energy market is pretty competitive and observable,” said Sheputis. “There’s not one wire from one utility to us. It’s a grid. There’s no guarantee it’s your utility’s electrons you’re getting. There are delivery points along the grid.”

Infomart’s Growing Footprint

Infomart’s focus on power helped the San Jose facility rebound during a roller coaster period in the Silicon Valley market. One of the company’s early tenants was Facebook, which in 2013 decided to migrate its West Coast servers to a new data center campus in Oregon. The impact of Facebook’s departure was felt by many wholesale data center providers, including Infomart.

“We went from full to empty and now back to full,” said Sheputis.

Almost full, anyway. Infomart has leased 70 percent of the capacity in its 9.3 megawatt data center to three public companies – EMC, a major cloud provider and a media streaming company. Demand is strong enough that the company is preparing to convert a second building on the site to data center use, adding 6 megawatts of capacity.

Infomart’s growth in Portland is driven by a major expansion by LinkedIn, which is the anchor tenant in an expansion phase of the Infomart data center in the data center cluster adjacent to the Intel campus in Hillsboro.[clickToTweet tweet=”John Sheputis: There’s not one wire from one utility to us. It’s a grid. ” quote=”John Sheputis: There’s not one wire from one utility to us. It’s a grid. “]

“The beauty of this location is that we have direct access to green power, which is one of our specific criteria for selecting new data centers,” writed LinkedIn’s Michael Yamaguchi in the announcement of the expansion.

Sheputis says the two-phase buildout for LinkedIn will be “the most sustainable data center in the world,” combining renewable power with an extremely efficient high-density design using rear-door cooling units, which eliminate the need for some elements of traditional data center cooling infrastructure.

A data hall inside an Infomart Data Centers facility in San Jose. (Photo: Infomart)

Infomart’s newest facility is in Ashburn, Virginia, where it acquired a former AOL data center and has upgraded the mechanical and electrical infrastructure. The first phase will be about 6 megawatts, with a second phase to follow with an additional 9 megawatts.

Sheputis says Infomart is studying whether to seek direct access through Dominion Virginia Power, the local utility serving Ashburn. In Virginia, customers with annual demand of 5 megawatts or more can shop for competitive electricity suppliers, but it appears to be exceedingly rare. Dominion reports that of the 1,865 customers eligible to pursue competitive pricing, just one has done so. One reason for this is pricing, which is very competitive at about 5 cents per kWh for Dominion, leaving less room for improved pricing that would justify a switch.

Infomart’s flagship building is the Infomart at 1950 Stemmons Freeway in Dallas, a 1.56 million square foot building that houses more than 70 carriers and many data centers providers. The building was acquired with a long-term power agreement in place, but Infomart will have options when that contract expires.

Texas introduced competitive electric markets in 2002, creating a system where electric generation and supply is a retail business competing for customers while the transmission remains heavily regulated. The confluence of a competitive market, the abundance of in-state power sources (notably natural gas), and a standalone power grid have driven power costs in the Dallas/Fort Worth market lower in recent years.

Is More Choice Coming?

Working to procure renewable energy can be challenging. Data center specialist Switch was determined to obtain renewable power to support its facilities in Nevada, and at one point filed an application to leave the NV Energy system to buy power directly from a solar energy company. Switch’s effort to leave the NV Energy system was blocked by the Nevada Public Utility Commission, and the parties eventually reached a compromise in which NV Energy agreed to sell green energy to Switch from a new solar generation facility being built by First Solar. The parties later wound up in court over the dispute.

One of the leading advocates for renewable power sourcing has been Greenpeace, which has waged public media campaigns critiquing the reliance on non-renewable power by Facebook and Apple, among others.

“Greenpeace is picking on the consumer who doesn’t have a lot of choice,” said Sheputis, who said he expects the options to improve over time.

“We’ve been a leader in being transparent,” he said. “We are promoting choice, acting on that choice, and showing other people how to do it.”