Roundtable: Gauging the Level of Data Center Liquid Cooling Expectations

The AI tsunami has carried with it a wave of GPU-driven liquid cooling expectations for data centers. But the question of how fast and in how many locations the immediate transition to data center liquid cooling can happen for hyperscalers and expanding colocation players may depend on how expeditiously they can be fed with vital streams of up-front investment.

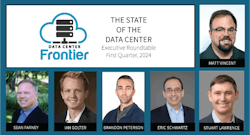

For today's installment of Data Center Frontier's Q1 Executive Roundtable, our five data center industry leaders share their opinions as to whether data center operators’ level of short-term investment is keeping pace with the level of anticipation surrounding the range of data center liquid cooling technologies.

Our distinguished panel of leaders for the First Quarter of 2024 includes:

Sean Farney, VP of Data Center Strategy for the Americas, JLL

Ian Golter, Engineered Solutions Manager - Datacenters, Kohler Co.

Brandon Peterson, Senior VP of Business Development, CoolIT Systems

Stuart Lawrence, VP, Product Innovation & Sustainability, Stream Data Centers

Eric Schwartz, CEO, CyrusOne

Now onto the third question of the week for our Executive Roundtable for the First Quarter of 2024.

Data Center Frontier: Is data center operators’ level of short-term investment keeping pace with the level of hype surrounding the range of data center liquid cooling technologies; and if not, when do you think the industry will see these vectors converge?

Sean Farney, JLL: Absolutely — I'm working with clients across all segments and sectors, researching and testing new cooling tech to handle the extreme challenge of AI's exorbitant cabinet densities.

The industry is pursuing solutions at a frenzied pace, from rear door heat exchangers to direct-to-chip and immersion. We just don't yet know which solution will ultimately win. But we must move ahead, not letting the fear of the unknown "how" stop us from pursuing the known "what."

Although (understandably) scary to critical environment operators, this unknown is exciting and driving incredible Create Destruction. I haven't seen this type of energy, mission and friendly competition since the early days of power utilization efficiency (PUE) gamification 10+ years ago.

So, operators are, by design, taking a short-term, tactical approach to technology selection before going all-in and making strategic investments in replacement cooling tech because they know it's a growing part of their value chain going forward.

Now, it’s possible that over the next three years, we will see one of the solutions establish dominance. However, based on what our clients are doing, I suspect that the prevailing model will be a hybrid of multiple cooling technology derivatives — both air and water — that addresses different densities and heat loads in the same facility.

I say this because we have GWs upon GWs of installed technology that can continue to serve traditional densities. We also know that even deep-pocketed hyperscalers are not building 1,000,000-square-foot facilities dedicated exclusively to AI computing, because it is not yet hyperscalable.

Brandon Peterson, CoolIT Systems: We’ve seen data center operators over the past two years accelerate their pace of investment in preparation for liquid-cooling.

For large data center operators, it is difficult to rapidly change the direction of generational data center designs which are launched over time after careful engineering and supply chain preparations.

This has implications on technology and product selection, resulting in trade offs being made in terms of performance, cost, feasibility and availability.

The best solution may not be the available solution in the next 1 – 2 years as many of these companies compete for allocation of capacity through the supply chain for the products they need in their data centers.

This will, however, rapidly evolve over the next 3 – 5 years after sufficient time has been invested in preparing for next-generation data center designs.

Stuart Lawrence, Stream Data Centers: At Stream we have been concerned about the supply chain impacts of incorporating liquid cooling for some time.

With scarce information on the availability of scale DLC solutions, we worked closely with our customers to architect a solution that meets the needs of our customers high density air cooled solutions today and allows for an easy switch to liquid cooled IT in the future.

The ability to accommodate both air and liqiuid cooling modalities, without impacting space, cost, embodied carbon and scheduled is a differentiator.

In addition, since our solution is unique to Stream, we have been able to guaranteed over 200MW of annual production capacity.

Eric Schwartz, CyrusOne: For CyrusOne, I am confident that we are keeping pace and well prepared to support customer requirements for liquid cooling.

The industry as a whole is pursuing multiple approaches and designs for liquid cooling, and our Intelliscale design and capabilities and well-suited to support many different topologies at high levels of performance.

Our challenge is to help customers understand how to fully exploit the flexibility that we offer in support of these cooling technologies.

Next: Where North American Data Center Supply Chain Challenges Meet Creative Industry Alliances

Matt Vincent

A B2B technology journalist and editor with more than two decades of experience, Matt Vincent is Editor in Chief of Data Center Frontier.