Identifying the Top 20 Markets and Locations for Hyperscale and Colocation Data Centers

In a pair of announcements this month, the industry analysts at Synergy Research Group have identified the world's top 20 metro markets for colocation data centers, as well as the top 20 global locations for hyperscale facilities.

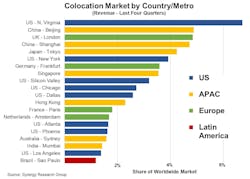

Top 20 Metro Markets for Colocation Data Centers

Synergy's data shows that just twenty metro regions account for 60% of the world’s current colocation data center market. The research is based on Synergy's in-depth quarterly tracking of such markets, including both retail and wholesale colocation segments.

The analyst notes that while there is a strong local and national aspect to colocation, on a worldwide basis the leading companies at present include Equinix, Digital Realty, NTT, China Telecom, CyrusOne and GDS.

"Proximity to customers is a key driver of the colocation market, so data centers tend to be located in metros that have a large concentration of companies and economic activity," points out John Dinsdale, Chief Analyst at Synergy Research Group, who adds, "That will not change but what we are seeing is the increasing emergence of many metros in countries that have smaller economies, but which are growing rapidly."

According to the research, Northern Virginia is the single largest global colocation market, accounting for almost 7% of the worldwide total. Northern Virginia is followed by Beijing, London and Shanghai, each accounting for about 5% of the total, followed by Tokyo at 4%.

Of the world's top 20 colocation markets, eight are in the US, seven in the APAC region, four in Europe and one in Latin America. Synergy notes that after the top 20 markets, the next twenty largest state or metro markets account for another 13% of the market, with the US and Europe featuring more prominently in that batch.

Synergy Research notes that Northern Virginia is a unique market in that the area was foundational to the early years of Internet infrastructure and has remained a center of gravity for data center activity, benefitting from a rich networking ecosystem, a business-friendly environment, and a good supply of low-cost power.

Beyond Northern Virginia, the other leading colocation markets, per Synergy's assessment, mainly reflect the world's leading economic hubs. According to the study, outside of the top forty markets, global metros which are growing extremely rapidly include Johor, Jakarta, Chennai, Lagos, Rio de Janeiro, Johannesburg and Queretaro.

“Countries like Malaysia, Indonesia, Nigeria and South Africa are all interesting opportunities, while in Latin America the market has developed beyond the historic focal point of Sao Paulo, and we're now seeing high growth in metros like Santiago, Rio de Janeiro and Queretaro," remarks Synergy's Dinsdale.

He adds, "It is also the case that increasingly there are power or geographic constraints limiting growth in some traditional metros, pushing growth opportunities into neighboring regions. These emerging metro markets will not reach the scale of a Singapore or a Frankfurt any time soon, but they will increasingly reshape the evolving colocation market."

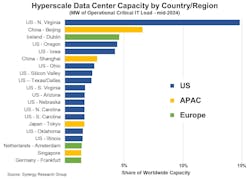

Top 20 Global Locations for Hyperscale Data Centers

Meanwhile, Synergy's latest data shows that just twenty state or metro markets account for 62% of the world’s current hyperscale data center capacity.

The study finds Northern Virginia and the Greater Beijing area alone make up 22% of the total. These locations are followed by Dublin, the US states of Oregon and Iowa, and then Shanghai.

The research is based on Synergy's analysis of the data center footprint of 19 of the world’s major cloud and internet service firms, including the largest operators in SaaS, IaaS, PaaS, search, social networking, e-commerce and gaming.

Unsurprisingly, according to the data, the companies with the broadest global hyperscale data center footprint are the leading cloud providers – Amazon, Microsoft and Google. In addition to a huge data center footprint in the domestic US market, each also operates multiple data centers in many other countries.

In aggregate according to the study, the three cloud giants now account for 60% of all hyperscale data center capacity. They're followed in Synergy's ranking by Meta/Facebook, Alibaba, Tencent, Apple, ByteDance, as well as a number of other relatively smaller hyperscale operators.

Synergy says its forecast growth numbers are based in large part on the researcher's tracking of hyperscale operators’ pipeline of future data centers. The researcher's known pipeline of future hyperscale data centers currently stands at 510 facilities, which it says are at various stages of being planned, developed or fitted out.

Of the top 20 global hyperscale markets per Synergy Research, 13 are in the US, four in the APAC region and three in Europe. After the top 20, the next twenty largest state or metro markets account for another 18% of the market, with Europe and the APAC region featuring more prominently in that batch.

The analyst emphasized that prevalence of US markets in the top twenty hyperscalers' ranking is mainly owing to two factors. First, that almost 60% of the world’s hyperscale operators are headquartered in the US, including the four biggest; and second, that the US accounts for almost half of all cloud market revenues.

“A range of factors influence the choice of location for hyperscale infrastructure, including proximity to customers, availability and cost of real estate, availability and cost of power, networking infrastructure, ease of doing business, local financial incentives, political stability, and minimizing the impact of natural hazards,” notes Synergy's Dinsdale.

Dinsdale adds, “When you weigh up those factors it tends to mitigate against some of the world’s biggest economic hubs, like London and New York, while favoring some sparsely populated US states like Oregon, Iowa and Nebraska. That makes for a different mix of leading markets compared to retail colocation data centers, which hyperscale companies often use to house their edge-oriented infrastructure."

Looking ahead, Synergy Research forecasts that the US and China will continue to dominate the numbers for global hyperscalers, though countries such Malaysia, India and Spain will start to feature much more prominently.

Dinsdale concludes, "While the general location decision criteria will remain the same over the coming years, the mix of top markets will change, driven mainly by high growth in emerging markets such as parts of Southeast Asia and Latin America.”

About the Author

Matt Vincent

A B2B technology journalist and editor with more than two decades of experience, Matt Vincent is Editor in Chief of Data Center Frontier.