Swollen Cloud Market Surges Again in Q1; Enterprise GenAI Enthusiasm Ramps: Data Center Industry Analysts

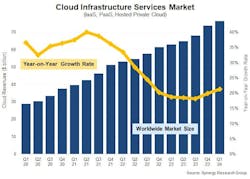

Fresh off the firm's view into 1000 hyperscale data centers operating globally (with over half in the U.S.), the latest report from Synergy Research Group (Reno, Nevada) shows that Q1 enterprise spending on cloud infrastructure services well exceeded $76 billion worldwide, rising $13.5 billion or 21% from the first quarter of 2023.

Synergy Research noted that this marks the second consecutive quarter in which the cloud market's year-on-year growth rate has markedly improved, with Q1 seeing the strongest growth since the third quarter of 2022.

Competitive Positioning

In terms of competitive positioning, Synergy Research noted that Amazon Web Services maintains a strong lead in the market, though Microsoft and Google had the stronger year-on-year growth numbers.

All three saw their growth rates increase substantially in the last two quarters, according to the firm. Q1 worldwide market shares for the three cloud giants were 31%, 25% and 11% respectively.

Per the research, among the tier two cloud providers, those with the highest year-on-year growth rates included Huawei, Snowflake, MongoDB and Oracle.

With most of the major cloud providers having now released their earnings data for Q1, Synergy estimates that quarterly cloud infrastructure service revenues, including the segments for IaaS, PaaS and hosted private cloud services, were $76.5 billion, with trailing twelve-month revenues reaching $283 billion.

Public IaaS and PaaS services reportedly account for the bulk of the market -- and those grew by 23% in Q1.

Synergy Research notes that the dominance of the major cloud providers is even more pronounced in public cloud, where the top three account for 72% of the market.

Geographic Breakdown

Geographically, the cloud market continues to grow strongly in all regions of the world.

When measured in local currencies, Synergy Research found that the APAC region had the strongest growth, with India, Japan, Australia and South Korea all growing by 25% or more year over year.

As evinced by the firm's aforementioned previous report, the researcher noted that the U.S. remains by far the largest cloud market, with its scale surpassing the whole APAC region.

Synergy Research reported that the U.S. market grew by 20% in Q1.

GenAI is King?

Though there are still some economic, currency and political headwinds challenging the cloud infrastructure services market, the analyst reckons these have diminished somewhat.

“[We] reported that in late 2022 and through much of 2023 cloud market growth rates were abnormally low, held back by external factors,” said John Dinsdale, Chief Analyst at Synergy Research Group. "We forecast that growth rates would bounce back, and that is what we are now seeing."

Meanwhile, Synergy notes that the underlying strength of the market is more than compensating for such constraints -- aided in no small part by the impact of generative AI technology and services.

“In terms of annualized run rate we now have a $300 billion market which is growing at 21% per year," noted Dinsdale. "We will not return to the growth rates seen prior to 2022 -- as the market has become too massive to grow that rapidly -- but we will see the market continue to expand substantially. We are forecasting that it will double in size over the next four years.”

As well and correspondingly noted in a new article commenting on the same research by TheNextPlatform's Timothy Prickett Morgan:

"As 2023 was coming to a close, Dinsdale says that there were a total of 992 hyperscale datacenters in the world, which is 4x the number that were in existence four years ago. In Q1 2024, the number of these massive data centers (which hold tens of thousands and sometimes 100,000 servers), passed through 1,000 worldwide.

Going forward, Dinsdale expects for somewhere between 120 and 130 additional hyperscale datacenters to be built, and as you might be surmising, GenAI is the core driver in this new capacity."

Notably, Prickett Morgan adds, "And thus, in the next four years, because the power and compute density of machinery is rising faster than the data center count, the aggregate gigawatts of power used by hyperscale data centers will double even though the data center count will only increase by about 50 percent to 1,500 worldwide."

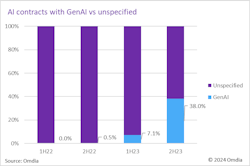

As another symptom of this atmosphere of burgeoning data center demand, nearly continguous data from competitive industry researcher Omdia confirmed that enterprise enthusiasm for generative AI surged in late 2023.

Parsing Enterprise GenAI Contracts and Use Cases

In March, Omdia said that findings from its "Enterprise AI Contracts Database" revealed AI contracts specifying GenAI jumped from 7% of contracts in the first half of 2023 to 38% in the second half of the year.

Omdia also found that annually, the number of GenAI-specified contracts increased from just one in 2022 to 96 ( or 23% of contracts) in 2023.

The researcher said the overall trend suggests that "enterprises are truly adopting GenAI and that GenAI is rapidly growing share in the AI market." The firm added that the amount of contracts also suggests that some enterprises are simply "in a GenAI exploration phase."

Omdia said its Enterprise AI Contracts Database covers approximately 100 contracts and related vendor announcements each quarter.

First published in 2020, the database now contains more than 1700 records. Each record identifies the chief AI use case covered by the contract, the industry of the end user, and their geographic territory.

The latest contracts data identified which sectors have the most interest in GenAI. Unsurprisingly, information technology was revealed as the most intensive adopter of GenAI, with more than half of IT industry contract announcements mentioning GenAI.

Healthcare, business services, media and entertainment, retail, and financial services also have above-trend interest in GenAI, according to Omdia.

The analyst noted that, by far, the largest use case for GenAI among these contracts is virtual assistants, to facilitate customer service and engagement. The second largest use case is intelligent process automation, to improve efficiency and productivity.

Per Omdia, other GenAI use cases with multiple contracts include sports video and stats analytics (fan engagement), automated report generation, and digital experience marketing (personalized marketing).

An Omdia statement qualifed the case thusly:

While contracts may surface trends in market activity, they more precisely publicize what vendors and end-users want their investors, customers, and competitors to know.

Vendors are eager to showcase new GenAI product sales. End-users want to demonstrate their digital savvy in deploying cutting-edge technologies and appear as leaders in a GenAI revolution.

Some of the announcements, especially those related to cloud-service-provider contracts (e.g., Google, AWS), indicate a range of areas where GenAI may be deployed.

“This approach may suggest some enterprises are taking shotgun aim at GenAI to see where the technology best benefits,” noted Neil Dunay, Principal Forecaster for Omdia.“Alternatively, it could signal a squandering of investment resources, if enterprises aren’t properly scoping GenAI use cases that best fit their needs.”

About the Author

Matt Vincent

A B2B technology journalist and editor with more than two decades of experience, Matt Vincent is Editor in Chief of Data Center Frontier.