Data Bytes: IDC Sees Enterprise Cloud Shift Accelerating in 2021

The pandemic is likely to hasten the migration of enterprise IT equipment out of on-premises data centers and into data centers operated by cloud service providers and colocation specialist, according to International Data Corporation (IDC), which last week outlined its predictions for 2021 and beyond in the global IT sector.

“The COVID-19 pandemic highlighted that the ability to rapidly adapt and respond to unplanned/foreseen business disruptions will be a clearer determiner of success in our increasingly digitalized economy,” said IDC Group Vice President for Worldwide Research, Rick Villars. “A large percentage of a future enterprise’s revenue depends upon the responsiveness, scalability, and resiliency of its infrastructure, applications, and data resources.”

IDC’s top prediction? The shift to cloud-centric IT will accelerate. “By the end of 2021, based on lessons learned, 80% of enterprises will put a mechanism in place to shift to cloud-centric infrastructure and applications twice as fast as before the pandemic,” IDC said. “CIOs must accelerate the transition to a cloud-centric IT model to maintain competitive parity and to make the organization more digitally resilient.”

IDC says the COVID-19 pandemic will dramatically alter the global business ecosystem for the next 12–24 months and beyond. The global economy remains on its way to its “digital destiny” as most products and services are based on a digital delivery model or require digital augmentation to remain competitive. With this shift, 65% of global GDP is digitalized by 2022, driving $6.8 trillion of IT spending from 2020 to 2023.

To succeed in this period of change, CIOs and digitally driven C-suites need to focus on three areas over the next five years.

- In the near term, they need to remediate any shortcomings in existing IT environments that were introduced during the initial emergency response.

- They also need to identify where the crisis and their organization’s response has accelerated IT transformation trends and lock in these advances.

- Most important, they must seek opportunities to leverage new technologies to take advantage of competitive/industry disruptions and extend capabilities for business acceleration in the Next Normal.

See the press release for the IDC Futurescape predictions.

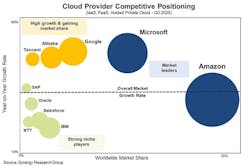

Growth Continues for Major Cloud Platforms

Enterprise spending on cloud infrastructure services hit almost $33 billion in the third quarter, according to Synergy Research Group, up 33% from the third quarter of 2019. Amazon and Microsoft continue to account for more than half of the worldwide market, with Amazon market share remaining at its long-standing mark of around 33%, while Microsoft’s share was roughly 18%. Google, Alibaba and Tencent are all growing more rapidly than the overall market and are gaining market share. Together they account for 17% of the market. The other cloud providers in the top ten ranking are IBM, Salesforce, Oracle, NTT and SAP. In aggregate the top ten providers account for 80% of the worldwide market, with the remaining 20% coming from a long tail of small cloud providers or large companies with only a small position in the market.

“While we were fully expecting continued strong growth in the market, the scale of the growth in Q3 was a little surprising,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “Total revenues were up by $2.5 billion from the previous quarter causing the year-on-year growth rate to nudge upwards, which is unusual for such a large market. It is quite clear that COVID-19 has provided an added boost to a market that was already developing rapidly,

“Meanwhile, the companies competing for a share of the market have settled into three camps,” he added. “Amazon and Microsoft are in a league of their own, while others are either aggressively seeking to grow their position in the market or are more focused on specific services, geographies or customer groupings.”

With most of the major cloud providers having now released their earnings data for Q3, Synergy estimates that quarterly cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) were $32.8 billion, with trailing 12-month revenues reaching $119 billion. Public IaaS and PaaS services account for the bulk of the market and those grew by 35% in Q3. The dominance of the major cloud providers is even more pronounced in public cloud, where the top five control almost 80% of the market.

About the Author