AWS Has Spent $35 Billion on its Northern Virginia Data Centers

Amazon Web Services (AWS) has spent $35 billion on its cloud computing infrastructure in Northern Virginia over the past 10 years, the company said, illustrating the enormous impact data centers can have on regional economies.

The disclosure also highlights the huge expense of creating the cloud computing platforms that power the global economy. Amazon is among a handful of huge tech companies – known as hyperscale operators – with the financial strength to play a leading role in cloud infrastructure.

Why so much spending in Virginia? Amazon’s $35 billion investment supports the AWS US-East Northern Virginia cloud region, which includes more than 50 data centers. It’s the largest single concentration of corporate data centers on earth, positioned near a strategic Internet intersection in Ashburn, which serves as a global crossroads for data traffic. As the cloud grows, the ability to add servers near Ashburn has become the table stakes for companies with ambitions in cloud computing.

Converting Buildings and Bits Into Business

The data center cluster in Northern Virginia is just one component of Amazon’s cloud infrastructure, which includes seven AWS regions in North America and 25 across the globe.

Cloud services have become essential to the economy, especially during the COVID-19 pandemic. Building the data centers to provide those cloud services is a capital-intensive business.

Amazon’s investment in cloud data centers has paid off in the performance of AWS, which generated $45 billion in revenue in 2020 and accounted for 54 percent of Amazon’s operating income in its most recent quarter, delivering higher profit margins than much of the company’s retail operations.

Amazon reports overall numbers for capital expenditures, but rarely provides public info on its direct expenses for data center construction. The recent disclosures were shared in a document outlining Amazon’s economic impact in Virginia.

“The report shows the impact that can happen when government and industry work together to create growth opportunities for communities,” said Blair Anderson, Director of AWS Public Policy at Amazon, in a blog post.

The data drives home two important points: Cloud clusters can provide important benefits for local economies, and require a level of investment that limits the number of companies that can compete at scale.

AWS and its Economic Impact in Northern Virginia

Over the last decade Amazon has undertaken a massive expansion in Northern Virginia to provision more capacity to keep pace with the growth of the AWS cloud. AWS and its development partners are continuously acquiring land and building data centers to ensure that the company doesn’t run out of server space. This translates into jobs and spending to construct and operate the facilities, as well as tax revenue for local communities.

Amazon’s $35 billion included spending on IT equipment, construction labor and materials, utilities, security, data center employee salaries and third-party services to build and operate data centers. In 2020, Amazon estimates its data center activities contributed $1.3 billion in GDP and supported over 13,500 jobs in Virginia.

Here are some key data points on the employment and tax impact of its data centers in Northern Virginia and the counties where AWS has focused its investment:

- Data Center Equipment: AWS says it paid more than $220 million in business personal property taxes in 2020 for its data centers located in Fairfax, Loudoun, and Prince William counties in Northern Virginia – representing for about 20% of all personal property tax revenues received by these counties in the 2020 fiscal year.

- Data Center Construction: In 2020, AWS investments to build new data centers and expand existing ones supported approximately 8,000 full-time equivalent (FTE) jobs in Northern Virginia, including 4,100 on-site construction workers, 1,300 indirect jobs in the local supply chain, and 2,600 jobs in the broader economy.

- Data Center Operations: In 2020, Amazon data centers in Virginia supported 3,500 FTE onsite jobs, including both full-time AWS data center employees and part-time contract workers whose work hours were converted into a full-time equivalent for an equivalent comparison. The company estimates another 2,000 jobs are supported outside of its data centers, for an economic impact of $2.4 billion Virginia over the past decade.

- Renewable Energy: By 2023, Amazon plans to enable 15 new utility scale solar farms across Virginia, with a total capacity of 1.43 gigawatts (that’s 1,430 megawatts). Amazon is among the tech companies seeking more green power for their data centers in Northern Virginia.

A chart of construction employment to support Amazon Web Services data center projects in Virginia. (Image: Amazon)

Why is Amazon making these disclosures? The audience is clearly public officials and residents in the communities where AWS is locating its data centers. Google and Facebook have also released reports on the economic benefits of their data center projects.

Amazon’s sustainability initiatives are clearly a priority. In 2019, Greenpeace called out AWS, saying its adoption of green power is falling behind the growth of its cloud infrastructure in Northern Virginia. Since then the company has invested heavily in renewable energy, recently reaching 10 Gigawatts of solar and wind power.

Public scrutiny of large data center projects is now commonplace, as residents pay close attention to their impact on the environment, public resources, and quality of life. The accelerating pace of data center development has prompted a growing number of local disputes in Northern Virginia, as residents seek to block or revise plans to build new facilities in their town.

AWS is familiar with this trend, as its data center expansion in Haymarket in Prince William County was the focus of a four-year public controversy as residents fought against utility towers to support the project.

Cloud Building at Scale is Capital-Intensive

Amazon’s $35 billion investment in Virginia is certainly its largest investment in a single state. AWS US-East Virginia region is the company’s largest region, including six Availability Zones (AZs) – clusters of data centers within a region that allow customers to run instances of an application in several isolated locations to avoid a single point of failure. No other region in North America has more than four AZs.

That spending aligns with the massive capital needed to build out cloud computing platforms. Google, Microsoft and Facebook are also making big investments in their data center infrastructure, investing between $600 million and $4 billion for each data center campus they build.

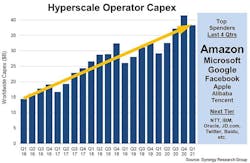

Synergy Research Group estimates that hyperscale operators invested $149 billion in capital expenditures on an annualized basis, with spending growing at about a 30 percent clip from year to year.

Trends in hyperscale data center capital investment. (Source: Synergy Research).

“Given the ongoing growth in service revenues for hyperscalers and the ever-increasing need for a larger global data center footprint, we are forecasting continued double-digit growth in hyperscale capex for several years to come,” said John Dinsdale, a Chief Analyst at Synergy Research Group.

About the Author